Are you bored of the current small market capitalization of REITs in Malaysia? I think Sunway REIT (the largest REIT right now) is by far sitting there very lonely without anyone closer to it. Come 7th December 2011, we will witnessed a new contender - Pavilion REIT, to challenge the title. Although it may started-off in 2nd place, the new REIT may grows to clinch the first place from SunREIT. Below is some info taken from RHB Research report on the IPO;

Pavilion REIT (PavREIT) has an asset size of RM3.5bn, just after the largest MREIT - Sunway REIT’s RM4.5bn. PavREIT has two assets – Pavilion KL Mall which is worth RM3.4bn and Pavilion Tower (office) RM128m.

The Prime Asset

Pavilion Mall is one of the only four premium retail malls in KL. It is designed to complement the malls along Jalan Bukit Bintang, developing the street to a key shopping destination in the region. Located at the “Golden Triangle”, which is the business, shopping, entertainment and tourism district, the mall enjoys massive catchment of population. It has an NLA of 1.33m sqf.

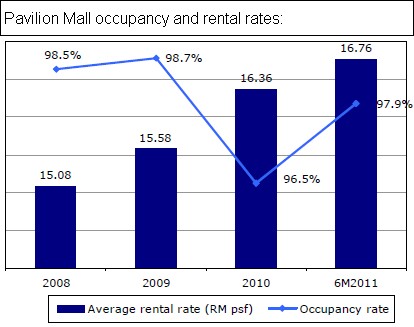

Since it commenced its operations in late 2007, occupancy has consistently stayed above 96%, with a 3-year CAGR of 4% in average rental rate. With such a short operating history, the mall has recorded 31m visits in 2010, comparable to Suria KLCC’s 40m footfalls. Over the longer term, Pavilion Mall is poised to enjoy higher number of visits as it will sit near to the upcoming MRT station, which is less than 300m away. The covered skybridge currently under construction that connects Pavilion Mall and KL Convention Centre which in turn adjoins Suria KLCC and the Petronas Twin Towers, will also pull in more shopper traffic between the two tourist spots.

The Pavilion Tower (NLA of 167k sqf) is an office tower connected to Pavilion Mall. It currently has an occupancy rate of 41.4% (expected to achieve 80% by year end), housing Malton roup, Mrail International, Clever Eagle and Aker Engineering (from 1st July). As the office tower only contributes about 2% to total rental income, coupled with the oversupply of office space in KL city centre, we are neutral on this commercial asset.

Future Growth Potential

Three other retail assets can potentially be injected in future for growth. PavREIT has been granted rights of first refusals (ROFR) by its sponsor and a 3rd party to purchase fahrenheit88, Pavilion Mall extension and an upcoming community mall in USJ Subang. These assets are estimated to have a combined value of about RM1.5-2bn. We believe the injection of assets will take 2-3 years, as only farenheit88 is still in the early stage of operation, and the other two malls will only be completed in three years’ time.

How to Value?

We benchmark PavREIT against KLCCP. Although KLCCP includes non-retail assets such as office towers and hotel apart from Suria KLCC, all these assets are of Grade A class. To reflect its prime status, we value PavREIT at a target yield of 5%, which is close to the average yield of 4.72% for KLCCP over the past 5 years (we gross up to exclude the impact of corporate tax – as REITs do not have corporate tax component). This translates to a fair value of RM1.14, based on our FY12 DPU estimate.

Source: RHB Research report

No comments:

Post a Comment