After being hit by a few Black Swan events, markets rebounded in March with the KLCI ending 1Q in the black. Moving into 2Q, we still see some short term volatility but are confident of an eventual rally to close in on our year-end KLCI target of 1680 points. We advise investors BUY Big Caps on potential rebounds while focusing on the more defensive Small Caps given their superior performance over the past few months. The favorite sectors remain Banks, O&G, Property and Construction in the mid-to-short term while the longer term buys are Media and Healthcare. This strategy is reflected in our April top buys as well.

Timber the BIG winner...

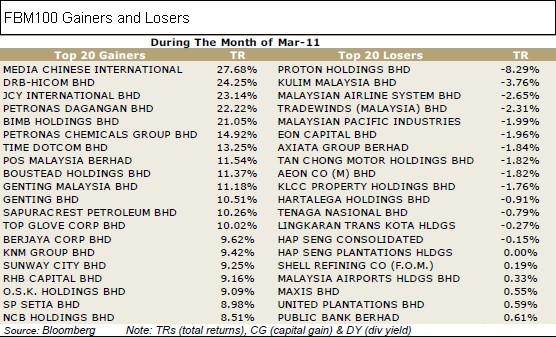

For March, timber stocks were actually the big winners, including names such as Suber Tiasa, Jaya Tiasa, TaAnn, WTK and Lingui, on hopes for better timber demand in view of reconstruction efforts in Japan. Nonetheless, these counters are not part of the FBM100. Instead, among the FBM100 constituents, media player Media Chinese and Petronas companies Petronas Dagangan and Chemicals were the big winners. Sectoral wise, O&G led the way followed by Technology (JCY), Media (MCIL), and Gaming (Genting).

Outlook: Moving into 2Q

Moving into 2Q, we see the possibility of some short-term volatility for the remainder of 2011 but market fundamentals remain sound. We maintain our year-end KLCI target of 1680 points based on an average of the 2011 KLCI fair value (1648 points 16x PER) and 2012 KLCI fair value (1710 points 15x PER). With this in mind, we maintain Overweight on the Malaysian market. Our view is driven by 4 key factors:

- The economy will continue to grow

- Upside and Downside are fairly equal

- News flow ahead of the General Election remains very supportive

- Earnings should match expectations

For April - A month of 2 Halves

We believe that there may well be 2 distinct halves in the month of April. The first half should be positive for the market, with the one of the key factors being the Invest Malaysia conference which will be held on 12 April. Among the announcements could be:

- The disposal of Khazanah's stake in Pos Malaysia

- The next Risk Service Contract for marginal oil fields

- Release of Government lands for property development

However, for the second half of the month, we are concerned of greater market volatility, due to potentially less positive outcome of the Sarawak elections. Since BN already holding more than 80% of the state seats, we believe the risk is that their performance may drop in this upcoming election. Consequently, this may spark some knee jerk selling until the 1Q2011 reporting season.

Source: OSK Reseach Report

No comments:

Post a Comment