"We are now Europe!" So said Rick Santelli on CNBC yesterday, as he responded to the negative GDP growth announcement for 4th quarter 2012. Santelli is right. We are now having the same silly discussions that go on routinely in Europe. We now think that somehow, someway the central bank can do something that makes it all better. And that somehow, someway, with sovereign debt exploding off into infinity, we can continue to spend and borrow our way to prosperity. It can't be done.

Economists have routinely become apologists for absurd economic policy, both in Europe and in the US. They often advocate raising minimum wages to increase employment. They have been in the forefront of advocacy for Obama policies that have brought the US economic recovery to its knees. Thank goodness for Santelli. He correctly notes that US sovereign debt problems are approaching Greek levels.

There was a time when US capitalism was the envy of the world. That time has passed. We are now simply a European basket case with all of the same problems that Greece, Spain and Italy have and for the same reasons. We are wealthier because of our free market history. But that is past history and we are now in a European present. Obama is succeeding in squeezing capitalism out of the US and the result is a stagnant, increasingly sick, economy on its way to modern day Greece and Spain.

Pretending that there is good news or economic strength in the worst economic recovery since the end of World War II is embarrassing. The facts on the ground are all to clear. The US is losing its pre-eminent position in the world economy and it is losing it at a fast clip. No amount of misleading news reporting by the American media can obscure the obvious fact of the decline of the American economic engine.

Three cheers for Santelli. He has it right.

Thursday, 31 January 2013

Net Worth Update (January 2013) - $60k mark

Current Net Worth | ||||

Assets | Dec-12 | Jan-13 | Change | % change |

Savings Account 1 | $5,225.48 | $5,596.71 | $371.23 | 7.10 |

Savings Account 2 | $5,045.70 | $5,008.16 | ($37.54) | -0.74 |

Savings Account 3 | $10,028.20 | $11,035.04 | $1,006.84 | 10.04 |

Investment Linked Fund | $7,475.68 | $8,150.06 | $674.38 | 9.02 |

Schroders Commodity Fund | $10,321.04 | $10,485.42 | $164.38 | 1.59 |

Stock Holdings | $9,365.00 | $10,115.00 | $750.00 | 8.01 |

Phillip Money Market Fund | $7,740.56 | $10,004.18 | $2,263.62 | 29.24 |

Physical cash | $1,000.00 | $1,000.00 | $0.00 | 0.00 |

Market Value Of BTO Flat (to be built in 2016/2017) | $750,000.00 | $750,000.00 | $0.00 | 0.00 |

Total Assets | $806,201.66 | $811,394.57 | $5,192.91 | 0.64 |

Liabilities | ||||

Home Loan | $617,500 | $617,500 | $0.00 | 0.00 |

Net Worth (including flat to be built in 2016/2017) | $188,701.66 | $193,894.57 | $5,192.91 | 2.75 |

Investible Net Worth | $56,201.66 | $61,394.57 | $5,192.91 | 9.24 |

Highlights

- Received a bursary valued at $2,900 and deposited a large portion of it into the Phillip Money Market Fund (currently yielding 0.5% per annum)

- 8% increase in value of stock holdings due to the recent spike in Biosensor's share price

- Expenses for the month totaled to $210 (average $6.80/day)

- Income from tuition, paid surveys and other part time jobs contributed to the increase in cash

Net worth target of $70,000 by December 2013 is definitely achievable now. In fact, I think my investible net worth will cross the $70k mark by mid 2013. February will be another good month due to Chinese New Year Ang Pows, second disbursement of bursary valued at $400 and a potential contribution from my girlfriend's performance bonus to our joint account.

Lastly, I have updated the "Net Worth", "My Asset Allocation" and "My Stock Portfolio" pages. For your information, I will be updating these pages on a monthly basis.

Lastly, I have updated the "Net Worth", "My Asset Allocation" and "My Stock Portfolio" pages. For your information, I will be updating these pages on a monthly basis.

Wednesday, 30 January 2013

State of Denial

The Obama Administration continues to trumpet the illusion that the economy is doing well. It isn't, Today's 4th quarter GDP numbers point to a declining GDP, not a growing GDP. The Obama enthusiasts in the media quickly found things within the report to like -- what else could they do? But, the undeniable fact is the economy is going nowhere.

If it were only the tax increases. But, there is so much more. Obamacare is kicking in and the EPA is clamping down hard on the economy. Meanwhile, Dodd-Frank implementation is destroying credit availability. The combination of all these things seems to get the Obama folks where they want to be -- the destruction of the American economic engine. They are succeeding. This morning's numbers bear testament. Stay tuned.

If it were only the tax increases. But, there is so much more. Obamacare is kicking in and the EPA is clamping down hard on the economy. Meanwhile, Dodd-Frank implementation is destroying credit availability. The combination of all these things seems to get the Obama folks where they want to be -- the destruction of the American economic engine. They are succeeding. This morning's numbers bear testament. Stay tuned.

NEW Aberdeen Islamic Funds

Aberdeen Islamic Asset Management Sdn Bhd has recently launched two shariah unit trust funds for the Malaysian market, the Aberdeen Islamic Malaysia Equity fund and the Aberdeen Islamic World Equity fund. The new funds are the company's 1st shariah retail products in Malaysia - and the 1st from a foreign fund manager under the special scheme - and come almost 8 years its parent company Aberdeen Asset Management Sdn Bhd was established to manage assets in Malaysia for institutions and corporate investors.

Malaysia: Turning promise into profit

Malaysia has long been rich in promise - rich because of its abundant natural resources, physical infrastructure and educated workforce. However it has not always maximize its advantages. In recent years that has changed as the country streamlines priorities. There is more emphasis now on efficiency, the private sector has a greater say across industries and more value is being created for shareholders. This enterprise is taking Malaysian companies overseas, too, helping businesses to sharpen their competitive edge.

Why Global then?

International markets are continually evolving, underpinned by increased movement of people, goods and capital around the world. But far from embracing 'globalization', research shows that investors tend to follow a home-country bias when it comes to their investments. As a result, they miss out on investments overseas that may offer steadier long-term returns as well as superior risk diversification.

|

| Fund Detail |

Source: Aberdeen Islamic Asset Management

Tuesday, 29 January 2013

The Managed Economy

There seems to be some euphoria surrounding the Obama White House that the economy may finally be on track. The stock market's behavior this month is a glowing chorus of approval, according to many observers. Perhaps, the economy can be managed after all. Perhaps, taxes and health care costs don't really matter after all. Perhaps, the collapse of Europe is irrelevant. Perhaps....

The cold reality, though, is that the numbers on the ground are still pitiful and have the potential to get worse. What little pulse the economy has is now an occasion for celebration in the White House. Strange. The American economy has historically provided 3 to 4 percent economic growth as the American middle class became the envy of the world.

Yes, the middle class has greatly improved its economic position over the last three decades. Only if employee benefits are left out of the calculation, which now amount to over 30 percent of employee compensation, can we reach the conclusion that the middle class is losing ground. The middle class was doing better than ever until 2009. Now, we have Obama. Good luck middle class!

In the new Obama economy, only those at the top of the stagecoach will do well -- the rich, the famous, the politically entrenched. Those who fight for jobs and profits in the private sector will remain under seige until the political climate changes....which won't be anytime soon with the retreat of the loyal opposition.

We have now entered the age of the "managed economy." The Fed combined with government subsidies to preferred friends have largely sucked out the marginal dollar from legitimate free market uses to political purposes. That spells no growth.

Businesses are still the enemy and they will remain the target of this administration. Don't expect any help from a Republican-controlled House of Representatives. The Republicans have fallen on their sword and should, deservedly, lose control of the House in 2014. They have lost the will to fight for anything other than social issues and are willing partners in the rush to expand government.

Don't expect much from the new "managed economy" other than the absence of economic growth and a large permanent underemployed and unemployed class of Americans.

The cold reality, though, is that the numbers on the ground are still pitiful and have the potential to get worse. What little pulse the economy has is now an occasion for celebration in the White House. Strange. The American economy has historically provided 3 to 4 percent economic growth as the American middle class became the envy of the world.

Yes, the middle class has greatly improved its economic position over the last three decades. Only if employee benefits are left out of the calculation, which now amount to over 30 percent of employee compensation, can we reach the conclusion that the middle class is losing ground. The middle class was doing better than ever until 2009. Now, we have Obama. Good luck middle class!

In the new Obama economy, only those at the top of the stagecoach will do well -- the rich, the famous, the politically entrenched. Those who fight for jobs and profits in the private sector will remain under seige until the political climate changes....which won't be anytime soon with the retreat of the loyal opposition.

We have now entered the age of the "managed economy." The Fed combined with government subsidies to preferred friends have largely sucked out the marginal dollar from legitimate free market uses to political purposes. That spells no growth.

Businesses are still the enemy and they will remain the target of this administration. Don't expect any help from a Republican-controlled House of Representatives. The Republicans have fallen on their sword and should, deservedly, lose control of the House in 2014. They have lost the will to fight for anything other than social issues and are willing partners in the rush to expand government.

Don't expect much from the new "managed economy" other than the absence of economic growth and a large permanent underemployed and unemployed class of Americans.

Saturday, 26 January 2013

Maximize Stock Returns Through Share Financing

Share Financing

Share financing is a loan facility offered by banks and brokerages to boost your purchasing power of stocks. You can pledge your stocks as collateral and engage in leveraged trading up to approximately 2 times the value of your pledged shares. As a member of the mass market, I do not get to enjoy the lower rates that Banks offer to priority/private clients. However, what I can do is to search for the best deal in the market and plan my moves accordingly so that I can leverage more effectively when the time comes.

Best Deal in the Market (Pls post a comment if any reader has a better deal)

After some research and comparison, I feel that OCBC's share financing account offers the best deal. By pledging shares, OCBC allows you to leverage up to 2.5 times. Also, it offers one of the lowest rates at 3.5% to 7.5% for different quality of stocks. For other banks such as DBS & CitiBank, they offer a rate of around 4.5 to 6% regardless of the quality of the stocks that you pledge. To enjoy the lowest rate (3.5%) from OCBC, you have to pledge stocks which are components of the Straits Times Index. If your portfolio comprises stocks of differing grades, the blended interest rate will be calculated based on the relevant interest rates which correspond to the various differing grades. However, the interest rates they offer are pegged to the prime rate and thus subject to periodic adjustments. To assess this risk, I extracted the prime lending rates for the past 20 years from the MAS website and tabulated them as shown below:

As we can see, prime lending rate has not been changing much since year 2001 and has been hovering in the 5.3% to 5.4% range. It should be safe to say that the prime lending rate will not change drastically in the next 5 years even in the event of a recession.

Also, the margin percentage (Total share value/Loan Amount) for OCBC is 140%. This means that a margin call will occur if the margin percentage falls below 140%.

Now, we have these information:

Strategy

During the next downturn/major correction, I will acquire stable dividend stocks which are components of the Straits Times Index and yield at least 5%. By purchasing STI component stocks which yield at least 5% and pledging them as collateral, I will be able to borrow money from OCBC share financing account at the lowest rate of 3.5% and also, the dividends will be sufficient to cover the interests. This means that any potential capital gain when the market recovers will be 'free'.

The maximum leverage power I have is 2 times the value of my pledged shares. To utilize this facility without over-leveraging and risking the dreaded margin call, I will borrow only 50% of the value of my pledged shares. For example, assume that I bought $100k worth of stocks during a market recession. I will then pledge these shares as collateral and borrow another $50k to buy more. Now, the total share value is $150k and the loan amount is $50k. My margin percentage(Total share value/Loan Amount) is now 300%. Recall that we have to maintain a margin percentage of 140% or more if not a margin call will occur. So assuming prices continue to drop another 50%, the value of my shares will then be $75k while loan amount is still $50k. Margin percentage is now 75/50 = 150% (still above threshold for margin call). In this example, I acquired stocks at depressed prices during downturn and the chances of the prices dropping another 50% should be unlikely. Risk of margin call is low in this case.

In a nutshell, this strategy is to accumulate STI component dividend stocks during market downturn and pledging them as collateral to enjoy a lower rate for buying more stocks on margin. Dividends should be sufficient to cover interests and investors get to earn the capital gains.

Share financing is a loan facility offered by banks and brokerages to boost your purchasing power of stocks. You can pledge your stocks as collateral and engage in leveraged trading up to approximately 2 times the value of your pledged shares. As a member of the mass market, I do not get to enjoy the lower rates that Banks offer to priority/private clients. However, what I can do is to search for the best deal in the market and plan my moves accordingly so that I can leverage more effectively when the time comes.

Best Deal in the Market (Pls post a comment if any reader has a better deal)

After some research and comparison, I feel that OCBC's share financing account offers the best deal. By pledging shares, OCBC allows you to leverage up to 2.5 times. Also, it offers one of the lowest rates at 3.5% to 7.5% for different quality of stocks. For other banks such as DBS & CitiBank, they offer a rate of around 4.5 to 6% regardless of the quality of the stocks that you pledge. To enjoy the lowest rate (3.5%) from OCBC, you have to pledge stocks which are components of the Straits Times Index. If your portfolio comprises stocks of differing grades, the blended interest rate will be calculated based on the relevant interest rates which correspond to the various differing grades. However, the interest rates they offer are pegged to the prime rate and thus subject to periodic adjustments. To assess this risk, I extracted the prime lending rates for the past 20 years from the MAS website and tabulated them as shown below:

Period | Prime Lending Rate | Period | Prime Lending Rate | |

1993 | 5.34 | 2003 | 5.3 | |

1994 | 6.49 | 2004 | 5.3 | |

1995 | 6.26 | 2005 | 5.3 | |

1996 | 6.26 | 2006 | 5.33 | |

1997 | 6.96 | 2007 | 5.33 | |

1998 | 5.9 | 2008 | 5.38 | |

1999 | 5.8 | 2009 | 5.38 | |

2000 | 5.8 | 2010 | 5.38 | |

2001 | 5.3 | 2011 | 5.38 | |

2002 | 5.35 | 2012 | 5.38 |

As we can see, prime lending rate has not been changing much since year 2001 and has been hovering in the 5.3% to 5.4% range. It should be safe to say that the prime lending rate will not change drastically in the next 5 years even in the event of a recession.

Also, the margin percentage (Total share value/Loan Amount) for OCBC is 140%. This means that a margin call will occur if the margin percentage falls below 140%.

Now, we have these information:

- Lending Rate = 3.5% to 7.5% depending on the quality of stocks pledged

- Lending Rate is 3.5% if pledged stocks are all components of the Straits Time Index

- Rates would most probably not adjust drastically in the next 5 years

- Margin percentage = 140%

- Leverage Power = 2 times of pledge stocks

Strategy

During the next downturn/major correction, I will acquire stable dividend stocks which are components of the Straits Times Index and yield at least 5%. By purchasing STI component stocks which yield at least 5% and pledging them as collateral, I will be able to borrow money from OCBC share financing account at the lowest rate of 3.5% and also, the dividends will be sufficient to cover the interests. This means that any potential capital gain when the market recovers will be 'free'.

The maximum leverage power I have is 2 times the value of my pledged shares. To utilize this facility without over-leveraging and risking the dreaded margin call, I will borrow only 50% of the value of my pledged shares. For example, assume that I bought $100k worth of stocks during a market recession. I will then pledge these shares as collateral and borrow another $50k to buy more. Now, the total share value is $150k and the loan amount is $50k. My margin percentage(Total share value/Loan Amount) is now 300%. Recall that we have to maintain a margin percentage of 140% or more if not a margin call will occur. So assuming prices continue to drop another 50%, the value of my shares will then be $75k while loan amount is still $50k. Margin percentage is now 75/50 = 150% (still above threshold for margin call). In this example, I acquired stocks at depressed prices during downturn and the chances of the prices dropping another 50% should be unlikely. Risk of margin call is low in this case.

In a nutshell, this strategy is to accumulate STI component dividend stocks during market downturn and pledging them as collateral to enjoy a lower rate for buying more stocks on margin. Dividends should be sufficient to cover interests and investors get to earn the capital gains.

Friday, 25 January 2013

Optimism Abounds

The stock market has thundered forward since the turn of the year. Unemployment claims are near their twelve month low and even California thinks it sees balanced budgets ahead in their future. So, are we there yet?

Unfortunately, nothing has really changed. Let's begin with California. California, New York and Illinois face an almost immediate crisis with their pension systems. These problems are far, far larger in magnitude than their total annual spending budget for everything else they do. And, the clock is ticking. These problems don't get better every day; they get worse.

California, like New York and Illinois, believe that higher tax rates have no effect on economic behavior. They are wrong. Thus, the revenue projections these states are expecting from higher tax rates are an illusion. Even without pension funding issues, these states are on a straight line to some form of bankruptcy, even if the day of reckoning is not (yet) known with certainty. These states have done nothing to reign in excessive spending or face up to unfunded liabilities....nothing at all, much like their big sister -- the US government.

At the national level, the US remains mired in the slowest economy recovery in modern times. New and higher taxes that impact almost all Americans and almost all businesses (think income taxes, payroll taxes, Obamacare-imposed taxes and higher health insurance rates for almost everyone). These new taxes will slow any green shoots in the economy from gaining enough strength to power a real recovery. Expect continued stagnation, continued high unemployment.

What about Europe? Aren't things better there? There is certainly a pervading sense of euphoria that the worst is over. Is it? What has changed? Today, Europe has significantly more sovereign debt than it had two years ago. Today, the Eurozone is in a recession which it wasn't in two years ago. Today, the same stultifying labor laws and regulations maintain their stranglehold on European economies. No real change there.

Recall the fall of 2007. This was a time period a full year after the housing market had begun its collapse and after several large mortgage companies had gone bankrupt. This was a time three months after the asset-backed securities market (a market responsible for 20 percent of all debt financing in the US) had ceased to function.

What happened with all of these problems staring us in the face? The stock market surged to an all time high topping 14,000 in October, 2007. Lehman Brothers and Bear Stearns traded at their all time highs in a burst of euphoria that the worst was over. Five months later Bear Stearns collapsed and within twelve months Lehman Brothers failed in the climax of the financial collapse of 2008.

It is an interesting question why the stock market surged in late 2007 after it was widely known that the housing market was in full freefall and that housing finance was shaking the foundations of most of the larger banks. One wonders why European stocks are surging today in face of the facts on the ground. As for the US markets, is current market enthusiasm well founded or are we repeating the late 2007 scenario?

Unfortunately, nothing has really changed. Let's begin with California. California, New York and Illinois face an almost immediate crisis with their pension systems. These problems are far, far larger in magnitude than their total annual spending budget for everything else they do. And, the clock is ticking. These problems don't get better every day; they get worse.

California, like New York and Illinois, believe that higher tax rates have no effect on economic behavior. They are wrong. Thus, the revenue projections these states are expecting from higher tax rates are an illusion. Even without pension funding issues, these states are on a straight line to some form of bankruptcy, even if the day of reckoning is not (yet) known with certainty. These states have done nothing to reign in excessive spending or face up to unfunded liabilities....nothing at all, much like their big sister -- the US government.

At the national level, the US remains mired in the slowest economy recovery in modern times. New and higher taxes that impact almost all Americans and almost all businesses (think income taxes, payroll taxes, Obamacare-imposed taxes and higher health insurance rates for almost everyone). These new taxes will slow any green shoots in the economy from gaining enough strength to power a real recovery. Expect continued stagnation, continued high unemployment.

What about Europe? Aren't things better there? There is certainly a pervading sense of euphoria that the worst is over. Is it? What has changed? Today, Europe has significantly more sovereign debt than it had two years ago. Today, the Eurozone is in a recession which it wasn't in two years ago. Today, the same stultifying labor laws and regulations maintain their stranglehold on European economies. No real change there.

Recall the fall of 2007. This was a time period a full year after the housing market had begun its collapse and after several large mortgage companies had gone bankrupt. This was a time three months after the asset-backed securities market (a market responsible for 20 percent of all debt financing in the US) had ceased to function.

What happened with all of these problems staring us in the face? The stock market surged to an all time high topping 14,000 in October, 2007. Lehman Brothers and Bear Stearns traded at their all time highs in a burst of euphoria that the worst was over. Five months later Bear Stearns collapsed and within twelve months Lehman Brothers failed in the climax of the financial collapse of 2008.

It is an interesting question why the stock market surged in late 2007 after it was widely known that the housing market was in full freefall and that housing finance was shaking the foundations of most of the larger banks. One wonders why European stocks are surging today in face of the facts on the ground. As for the US markets, is current market enthusiasm well founded or are we repeating the late 2007 scenario?

Tuesday, 22 January 2013

So Much for the National Debt

Obama's inauguration speech yesterday makes it pretty clear. He has no intention of discussing ways to lower the deficit and begin to tackle our national debt problems. Quite the reverse! Obama has more spending, taxing and regulating plans ahead for the next four years. As if the economy wasn't bad enough, Obama is planning more anti-capitalism moves.

You wonder if his advisers have any idea what the implications are for the economy of all of this. There was always the chance that a Republican House would block the most extreme measures, but that is becoming increasingly unlikely as Republicans tack feverishly in Obama's political direction.

Given Europe's situation, which is far, far worse than the pundits are saying, the economic outlook for the US is pretty bleak. The best that can be hoped for is more slow growth and stagnant employment. That is the very best that one can hope for! The worst is that the economy could begin to slip into recession mode. While pundits think Europe is doing better, the truth is that, compared to two years ago, the European economies are much, much weaker, the level of sovereign debt in Europe is much, much higher, and what little restraint on spending and regulation has lost its political support. Europe is doomed.

The real question is whether capitalism in the US is doomed as well. It may well be.

You wonder if his advisers have any idea what the implications are for the economy of all of this. There was always the chance that a Republican House would block the most extreme measures, but that is becoming increasingly unlikely as Republicans tack feverishly in Obama's political direction.

Given Europe's situation, which is far, far worse than the pundits are saying, the economic outlook for the US is pretty bleak. The best that can be hoped for is more slow growth and stagnant employment. That is the very best that one can hope for! The worst is that the economy could begin to slip into recession mode. While pundits think Europe is doing better, the truth is that, compared to two years ago, the European economies are much, much weaker, the level of sovereign debt in Europe is much, much higher, and what little restraint on spending and regulation has lost its political support. Europe is doomed.

The real question is whether capitalism in the US is doomed as well. It may well be.

Monday, 21 January 2013

CLSA Malaysia Politics Market Strategy

There is no better time to blog about this post. After the plunge of KLCI yesterday, citing election risk, we came across an interesting research report by CLSA. As such, we would like to take this opportunity to share with you.

By CLSA,

An unexpected opposition Pakatan Rakyat (PR) coalition victory in the impending 13th General Election (13GE) would spark a broad sell-off in Ringgit assets. Changes of government are not uncommon in ASEAN. Looking at the experience of Indonesia, Thailand and the Philippines over the last decade, parliamentary control has seen significant shifts and governance has been possible despite the lack of a parliamentary majority. However, Malaysia has never experienced a change in government, meaning any change will come as a shock and with a host of uncertainties.

From an equity and debt market perspective, Malaysia has always enjoyed a political premium for the stability in governance and policy-setting stemming from majority control of parliament. The immediate financial market repercussions can be grouped as follows:

- Equity and bond markets sell-offs are likely as Malaysia's political stability premium is erased, at least temporarily. Domestic corporate, many of which have deep links with the existing government, will be putting big-ticket decisions on hold pending guidance on continuity;

- Ringgit depreciation can be expected in parallel with the sell-off in Malaysian assets by foreign investors. This will pose another drag on broad corporate and foreign investor confidence, especially foreign debt (though positive impact on exporters should not be forgotten).

- And, subsequently draw unfavorable attention from international rating agencies.

Near-term policy expectations

- PR's stated policies are broadly aimed at raising disposable incomes, improving fiscal governance (key revenue generator), and encouraging private investment.

- Higher minimum wage and lower car prices will support consumer spending, while cutting ASEAN-topping corporate tax rate would reassure corporate and investors.

- State oil company Petronas will get more resources to invest in rebuilding reserves.

Medium-long term policy focus

- PR's desire to "rebalance" government contracts and agreements means negative overhangs for state-dependent entities i.e. utilities, concessionaires, construction.

- Banks as large holders of private sector bonds will face negative risk perception.

- Reversing GLC dominance (Iskandar not impacted) will boost private investment and FDI; Khazanah could accelerate local asset disposals, lifting Bursa's free-float.

"Rain or Shine" stock picks

- At the macro level, companies with government-dependent contracts, licenses and concessions will see sustained negative overhang and discounting, while consumer and oil & gas sectors will benefit from rising disposable income and Petronas capex.

- Our "rain or shine" stock picks are expected to do well under either a BN or PR-led government, with earnings underpinned by higher disposable incomes, Petronas association, overseas earnings contribution buffer and a weaker currency.

- A market sell-off would be a prime opportunity to add to positions in Axiata, PGas, UEM Land, IHH, Sapura Kencana, AirAsia and exporters e.g. rubber glove players.

Source: CLSA Asia-Pacific

Saturday, 19 January 2013

Republicans Go Over the Cliff

Too often, Democrats get blamed for our national debt problems and the economic stagnation that has come to characterize the US economy. Republicans deserve their share of the blame.

Who provided the votes necessary to escape considering our debt problems at the start of this year? Speaker Boehner violated the "Hastert Rule" and let the Senate bill come up for a vote which raised taxes. 48 Republicans then voted for the bill. A solid victory for Obama. A solid defeat for the American taxpayer. And, who engineered this? Republicans. Ditto for the emergency pork bill that passed the House last week. Once again, with Boehner's concurrence, Republicans provided the necessary votes to pass this abomination as well.

Yesterday, Republicans announced unilateral pre-emptory capitulation before the White House by pledging to extend the debt ceiling for three months in exchange for the usual -- nothing.

What is the difference between a Republican majority in the House of Representatives and a Democrat majority? The answer -- nothing at all.

You get the same legislation, the same bad economic policy. There is absolutely no difference.

Republicans object that the polls show that the public is on Obama's side. What did the polls show, then and now, about Obamacare as Obama jammed his unpopular health care through the Congress? It showed that Obamacare was unpopular then and unpopular now. But, did that matter? No

Obama saw it through. Say what you will. The Democrats believe in what they are pushing. The Republicans don't and it shows. Small wonder that Republicans have trouble getting their voters to the polls. Why bother?

Who provided the votes necessary to escape considering our debt problems at the start of this year? Speaker Boehner violated the "Hastert Rule" and let the Senate bill come up for a vote which raised taxes. 48 Republicans then voted for the bill. A solid victory for Obama. A solid defeat for the American taxpayer. And, who engineered this? Republicans. Ditto for the emergency pork bill that passed the House last week. Once again, with Boehner's concurrence, Republicans provided the necessary votes to pass this abomination as well.

Yesterday, Republicans announced unilateral pre-emptory capitulation before the White House by pledging to extend the debt ceiling for three months in exchange for the usual -- nothing.

What is the difference between a Republican majority in the House of Representatives and a Democrat majority? The answer -- nothing at all.

You get the same legislation, the same bad economic policy. There is absolutely no difference.

Republicans object that the polls show that the public is on Obama's side. What did the polls show, then and now, about Obamacare as Obama jammed his unpopular health care through the Congress? It showed that Obamacare was unpopular then and unpopular now. But, did that matter? No

Obama saw it through. Say what you will. The Democrats believe in what they are pushing. The Republicans don't and it shows. Small wonder that Republicans have trouble getting their voters to the polls. Why bother?

Who Are The Supercar Owners?

|

| KPO Cafe Bar |

Whenever I walk past the 'KPO Cafe Bar' situated beside Orchard Central, the fleet of supercars parked outside the bar never fails to impress me. I have seen cars like Audi R8, Lamborghini Aventador, Ferrari 458 Italia, Nissan GTR, BMW M3, Maserati GranTurismo and different models of Porsche, BMW, Mercedes, etc parked outside the bar. It subsequently piqued my curiosity on who are the people who own them and I started stealing glances of the customers drinking inside the bar and on the open air balcony.

Here are some of my observations:

- People dressed in their business attire can be seen drinking at the bar as early as 4-5pm

- About 30 to 50% of the customers are Caucasians

- Majority of them are in their early 30s to mid 40s

A first hand GTR already costs $350,000 including COE. Monthly maintenance is probably more than $4,000 including petrol, road tax, car insurance, ERP, etc. And we're only talking about a GTR which costs $350,000 here. What about an Audi R8 Spyder which costs twice as much? So who are these supercar owners? What do they do? How can they afford a supercar?

I feel that there are only a few possibilities:

- They are successful executives (lawyers, surgeons, bankers, etc)

- They are successful business owners or 2nd generation business owners

- Supercar belongs to father/family

- They are overleveraged

However, from my personal experience, not every wealthy person owns a supercar. For example, the owner of a venture capital firm that I interned at drives a humble Toyota Camry despite having a personal net worth of more than $30 million. The father of my good friend who earns more than a million dollars a year and stays in a Good Class Bungalow owns a Audi A4 and a Volvo S80.

Living in a country with the world's highest concentration of millionaires and the largest proportion of wealthy expatriates where 54% of them earns US$200,000 or more, I will have to work harder, save harder and invest smarter.

Friday, 18 January 2013

The New Wall Street

Better-than-expected results were common for the major money-center banks that reported earnings this week. The announcement of these "good results" were accompanied by more layoff notices from every large bank. Wall Street continues to downsize as the rest of the economy remains in hunker-down mode.

We are gradually becoming accustomed to accepting economic stagnation as the new normal. Reminiscent of the 1970s, Americans are becoming used to sluggish job prospects, sluggish income and wealth growth, and massive and continuing unemployment. All of this is now described, by the president's coterie of supporters in the media, as an improving economy. This is not an improving economy so much as a different economy.

The place to be is somewhere in the government or quasi-government sector. You can make high six figure incomes at a relaxed pace in the upper echelons of most large universities. Even better, you probably aren't at risk of being laid off. But, if your plan is to enter the private sector and work your way up, the historic pathway of the American dream, you can probably forget it.

Working for government, at any level, is the ticket. Once an economy reaches the degree of government control and government ownership that the American economy has reached, the pathway to success changes. You can't depend upon the vibrancy of the economy any longer. That vibrancy has been legislated out of existence. So heading off to the private sector is problematic. Instead, it is time to strap on your politics and find your way into a government job or a non-profit job or a job in the educational sector. That is the pathway to success in the new economy.

Of course, this means increasingly that economic growth will not happen. How can it, when most people that "work" aren't involved in producing anything. Many so-called "workers" are mainly enforcing laws that prohibit others from working. If you have an economy where a growing percentage of workers produce laws and regulations and then enforce them, while a dwindling few produce anything of substance, then the real pie can't grow.

Instead you create a national divide -- something we can already see emerging -- between those in the protected sectors of government, education, and non-profit (funded by tax-reducing so-called charitable donations) who have incomes and job security and those fending for their life in the increasingly marginalized private sector.

So, the new Wall Street is simply the most visible current display of the decline of American economic leadership. The Obama plan is working.

We are gradually becoming accustomed to accepting economic stagnation as the new normal. Reminiscent of the 1970s, Americans are becoming used to sluggish job prospects, sluggish income and wealth growth, and massive and continuing unemployment. All of this is now described, by the president's coterie of supporters in the media, as an improving economy. This is not an improving economy so much as a different economy.

The place to be is somewhere in the government or quasi-government sector. You can make high six figure incomes at a relaxed pace in the upper echelons of most large universities. Even better, you probably aren't at risk of being laid off. But, if your plan is to enter the private sector and work your way up, the historic pathway of the American dream, you can probably forget it.

Working for government, at any level, is the ticket. Once an economy reaches the degree of government control and government ownership that the American economy has reached, the pathway to success changes. You can't depend upon the vibrancy of the economy any longer. That vibrancy has been legislated out of existence. So heading off to the private sector is problematic. Instead, it is time to strap on your politics and find your way into a government job or a non-profit job or a job in the educational sector. That is the pathway to success in the new economy.

Of course, this means increasingly that economic growth will not happen. How can it, when most people that "work" aren't involved in producing anything. Many so-called "workers" are mainly enforcing laws that prohibit others from working. If you have an economy where a growing percentage of workers produce laws and regulations and then enforce them, while a dwindling few produce anything of substance, then the real pie can't grow.

Instead you create a national divide -- something we can already see emerging -- between those in the protected sectors of government, education, and non-profit (funded by tax-reducing so-called charitable donations) who have incomes and job security and those fending for their life in the increasingly marginalized private sector.

So, the new Wall Street is simply the most visible current display of the decline of American economic leadership. The Obama plan is working.

Wednesday, 16 January 2013

TA 2013 Malaysia Outlook: Ride the Volatility

By TA Securities,

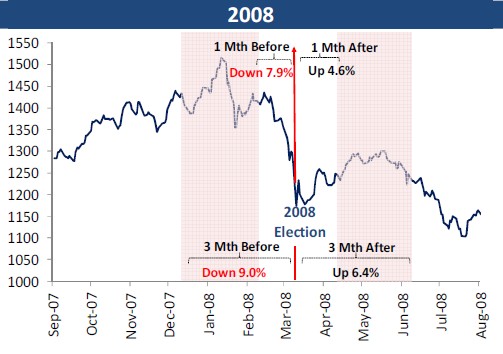

We believe 1H13 will be a choppy period and election concerns could drag down the FBM KLCI by 8% to 10% in the period before market rebounds in the 2H13. The impetus for revival will mainly hinge on the end of election overhang and strong domestic demand.

Sustained monetary easing on the back of low inflationary pressure and attempts to reduce budget deficits by cutting subsidies and channeling the savings to productive ventures are positive despite the short-term impact on earnings. Overall, domestic economy will play an integral role in sustaining confidence in domestic equities next year in the absence of any overwhelming micro drivers.

Corporate earnings for 9M12 were less robust and we forecast full year earnings growth for the FBM KLCI to be 9.4% only. Chances of a strong revival in the immediate-term are minimal based on external sentiment and dwindling demand in key export markets. Our earnings growth forecast of 8% and 8.4% for CY13 and CY14 is not compelling vis-a-vis key regional emerging market's 16.1% and 14.7% respectively. It could come under further pressure if the implementation of minimum wages had greater impact in raising the input cost than the intended increase in disposable income and spending. High likelihood of subsidy cuts (electricity tariff and fuel price increases) post 13th General Election would be negative on earnings and will prompt us to trim our CY13 and CY14 forecasts by 1.2% and 4.9% respectively.

How about Foreign Markets?

External factors will continue to dictate the market directions. The structural flaws cannot be undone overnight but expect bouts of positive improvements to kick in the 2H13 as fats are trimmed and jobs created. China could revive its domestic growth without stoking inflationary pressure but it can be destabilizing factor if its row with Japan escalates. The same applies to Iran and the West.

Can KLCI end Strong this year?

We derived our end-2013 target of 1,710 for FBM KLCI after applying 2008-2011 average forward PER of 14.3x on mid-cycle EPF of 120 sen. The underlying key assumption is that BN will return to power with slim majority. This target is a 5% discount to our bottom-up valuation of 1,800.

|

| FBM KLCI performance before and after 2008 Malaysia's election |

Strategy...

Sell-on-strength, especially overvalued defensive plays in the Consumer, Healthcare and Telco sectors and turn cash-heavy to accumulate high beta plays in domestic sectors, which are mainly related to Construction, Oil & Gas and Property sectors, in 1H13. Banking sector holds good buys based on their attractive valuation, still robust loan growth and bright chances of benefiting from ongoing domestic expansions.

Source: TA securities report

Labels:

Bursa Malaysia,

dividend,

election,

investment,

KLCI,

Malaysia,

outlook,

share

Subscribe to:

Posts (Atom)