The agreement reached on Thursday in the Eurozone sparked a major stock and bond rally in world financial markets. There was a nearly two percent pop across the globe. The agreement basically made each country responsible for every other country's commercial banking system. The next step will be Eurobonds, which makes every country responsible for the sovereign debt of all the other countries -- "joint and several" is the usual phrase.

Nothing, of course, in the agreement reigns in the growth of that sovereign debt or in way repairs commercial bank balance sheets. There is just a new signatory -- Germany. Now, if one looks only at Germany and ignores the rest of the Eurozone, it is clear that Germany itself is on the road to financial ruin, long before taking on the indebtedness of the likes of Greece, Spain, Italy, etc. The main thing that these agreements do is to eliminate any rational reason for the profligate countries to take any measures to curb their budget deficits or fess up about their commercial banking problems.

In American parlance, Europe has adopted the "extend and pretend" model writ large.

This will, briefly, postpone the day of reckoning -- maybe a week, maybe a month, maybe three months...but not much more than that. Then what: Have the man on the moon guarantee Germany's sovereign debt?

To see a defense of this madness, read Laura d'Andrea Tyson's column in the New York Times this morning. It spells out the usual stuff about how austerity doesn't work, which translates to "let the deficits ride to infinity." Tyson is among those that think that laws that prohibit firing don't really matter much to entrepreneurs. It must be nice to look at this from 30,000 feet in a business class seat and to not face the hard realities that Italian and Spanish business folks face every single day. Maybe on a clear day....

As we have pointed out ad nauseum in this blog, the issue in Europe is one of arithmetic. Sovereign deficits are spiraling off to infinity, while the economies, hampered mainly by over regulation and the welfare state (and not austerity...there is none), are grinding to a halt. Having mother Germany step up to the plate is largely irrelevant to where this all ends. It just means that Germany will suffer the same fate as everyone else.

There is no arguing with numbers. Unless the growing gap between spending and revenues is reversed, which, at present, there are no agreements to do, then sovereign debt in the Eurozone will continue to march toward the sky and bond buyers will continue to run for the exits.

Saturday 30 June 2012

Friday 29 June 2012

McDonnell Reappoints Dragas

I like Helen Dragas. I know that may sound strange, but I think she is very smart and well intentioned. We all make mistakes. I think her second term will prove out that she can be an outstanding member of the Board of Visitors.

But, you have to wonder about Governor McDonnell. What's he thinking? He announced the appointment as if the opposition to Dragas was gender based, which is completely ridiculous. What McDonnell still refuses to admit, at least publicly, is that he favored the ouster of Sullivan all along. That is the only conceivable explanation for Dragas's reappointment.

I would not worry about the Board of Visitors ganging up on Sullivan. I don't see that happening. I expect Dragas will be very cooperative and the future is likely to be harmonious.

But, you have to wonder about the Governor in all of this. No matter how you tell the story, the Governor's role is likely not to be one that history will look back on with admiration.

But, you have to wonder about Governor McDonnell. What's he thinking? He announced the appointment as if the opposition to Dragas was gender based, which is completely ridiculous. What McDonnell still refuses to admit, at least publicly, is that he favored the ouster of Sullivan all along. That is the only conceivable explanation for Dragas's reappointment.

I would not worry about the Board of Visitors ganging up on Sullivan. I don't see that happening. I expect Dragas will be very cooperative and the future is likely to be harmonious.

But, you have to wonder about the Governor in all of this. No matter how you tell the story, the Governor's role is likely not to be one that history will look back on with admiration.

The Supreme Court

Conservatives are castigating John Roberts for joining with four liberals to provide a path to constitutionality for Obamacare. Why pick on him? When Republicans are in political control, they do exactly the same thing.

Ever hear of "Americans for Disability Act," "The Prescription Drug Bill," "No Child Left Behind," etc. These are Republican initiatives passed by Republicans. Who were the biggest critics of Sarah Palin after she was the Republican nominee for VP? Karl Rove and Peggy Noonan -- two Republicans. What was her crime? She didn't read the NY Times and thought Russsia was across the Bering Straights (which it is).

Who coined the phrase "voodoo economics" to describe the Reagan tax cut plan? A conservative Republican, that's who. What Governor recently followed the advice of four liberal Democrats, against the advice of conservatives, to try to destabilize the University of Virginia? A conservative Republican that's who.

So, why pick on Roberts? Other than Scott Walker, Mitch Daniels, and Chris Christie, what other Republicans have made any effort at all to roll back the reach of government when they had the chance?

Republicans are only for limiting the reach of government, when they are out of office trying to get in. Once in, they behave like Democrats. So don't pick on Roberts, he's just following tradition. Isn't that what Supreme Court justices are supposed to do?

Ever hear of "Americans for Disability Act," "The Prescription Drug Bill," "No Child Left Behind," etc. These are Republican initiatives passed by Republicans. Who were the biggest critics of Sarah Palin after she was the Republican nominee for VP? Karl Rove and Peggy Noonan -- two Republicans. What was her crime? She didn't read the NY Times and thought Russsia was across the Bering Straights (which it is).

Who coined the phrase "voodoo economics" to describe the Reagan tax cut plan? A conservative Republican, that's who. What Governor recently followed the advice of four liberal Democrats, against the advice of conservatives, to try to destabilize the University of Virginia? A conservative Republican that's who.

So, why pick on Roberts? Other than Scott Walker, Mitch Daniels, and Chris Christie, what other Republicans have made any effort at all to roll back the reach of government when they had the chance?

Republicans are only for limiting the reach of government, when they are out of office trying to get in. Once in, they behave like Democrats. So don't pick on Roberts, he's just following tradition. Isn't that what Supreme Court justices are supposed to do?

Germany Slowly Getting Pulled In

What was a disastrous future for the southern periphery of Europe is now being extended to the northern states as well. Germany is the main target of this exercise. Today's agreement to accept near worthless bank equity by the European banking stabilization fund is an admission of hopelessness.

No one yet is reducing the yawning deficits or recapitalizing the insolvent banks that plague Europe. That's off the table for now. So, European debt continues to explode off to infinity while the paper-shuffling politicians rearrange the names of the guarantors. In the end, it won't matter. Germany will suffer the same fate as Greece and for the same reason. They can't pay their bills.

The problem in Europe is one of solvency, not one of liquidity. These patch jobs only make the final outcome much more severe than it would be if the real problems were faced with candor.

No one yet is reducing the yawning deficits or recapitalizing the insolvent banks that plague Europe. That's off the table for now. So, European debt continues to explode off to infinity while the paper-shuffling politicians rearrange the names of the guarantors. In the end, it won't matter. Germany will suffer the same fate as Greece and for the same reason. They can't pay their bills.

The problem in Europe is one of solvency, not one of liquidity. These patch jobs only make the final outcome much more severe than it would be if the real problems were faced with candor.

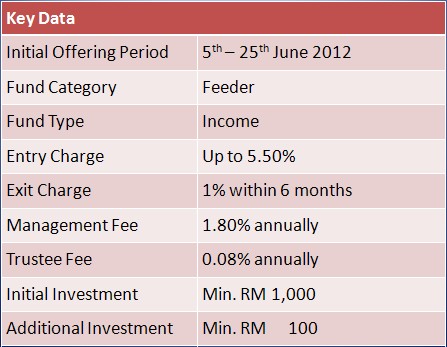

New Fund: AmDynamic Sukuk

After the spectacular performance of AmDynamic Bond fund, AmInvestment Services Bhd would like to replicate the success of the conventional fund into this newly launched shariah compliant fund.

The Fund aims to provide capital appreciation by investing primarily in Sukuk both locally and globally. To achieve the investment objective, the Fund will undertake active management to enhance and optimize returns from investing in sovereign, quasi-sovereign and corporate Sukuks. The sectorial weightings maybe adjusted to maximize the performance. There is no minimum rating for a Sukuk purchased or held by the Fund.

More about the Fund

Value-add of the Fund is derived from active tactical duration management, yield curve positioning and credit spread arbitrage. Credit spread arbitrage and yield curve positioning is part of relative value approach that involves analysis of general economic and market conditions and the use of models to analyze and compare expected returns as well as the assumed risks. The Investment Manager will focus on Sukuk that would deliver favourable return in light of the calculated risks.

In addition, the Investment Manager may also consider Sukuk with favourable or improving credit outlook that provide the potential for capital appreciation for these investments. The Fund may invest in Sukuk of varying maturities. The Fund’s investment maturity profile is subject to active tactical duration management in view of the interest rate scenario without any portfolio maturity limitation.

The Fund invests globally, including but not limited to Malaysia, Singapore, Indonesia, United Arab Emirates, Saudi Arabia, Bahrain, United Kingdom, Luxembourg, Jersey, Bermuda, Brunei, China, Australia, New Zealand, Japan, Hong Kong, United States of America and Germany. Notwithstanding the above, investments in foreign markets are limited to markets where the regulatory authority is a member of the International Organization of Securities Commission (IOSCO).

AmDynamic Sukuk is suitable for investors who:

- want steady growth in value by investing in Sukuk as an asset class;

- have Medium to Long Term investment goals; and

- are willing to assume additional interest rate risk, duration risk and liquidity risk associated with investing in Sukuks with longer duration and lower credit ratings.

Source: Fund's prospectus

Wednesday 27 June 2012

How Can A Profit-Guaranteed Investment Be Risky?

Investment professionals love complicating things.

Trust me on that. I was once like that.

You don’t believe me?

The next time you meet people from the investment industry, try asking them to give you a definition of the word “risk”.

Investopedia defines “risk” as “the chance that an investment’s actual return will be different than expected...risk is usually measured by the standard deviation of the historical/average return of a specific investment.”

Don’t get me wrong. This is actually a pretty good definition of "risk”... that is if you speak finance. But most people don’t, and if you are like most people, you probably struggled to understand even the first sentence (actual return vs expected return...huh?). Good luck attempting to measure risk!

Then, what does RISK mean?

Complicated definitions aside, many investment professionals define “risks” consistent with the above definition i.e. in terms of “uncertainty” (or “volatility”, a fancy word for uncertainty). Professionals refer to a risky investment as one with a “high standard deviation” or “high volatility” (or in our language, high “uncertainty”).The problem is, people don’t normally think of risk that way. An investment that is “uncertain” or “volatile” may not necessarily be risky. Let me give you an example;

Suppose there is no chance of losing money on this particular investment, but depending on a certain factor (e.g. how the weather turns out to be in a year’s time), you could either make a small profit or quadruple your money, or anywhere in between. We both know that if such an investment exists, it is a no brainer – this investment has no risk (you either win small or win BIG)!

But by definition, this investment is highly risky! Why? The outcome is highly uncertain: you could make a small profit (say +1%) or any amount up to quadrupling your money (+300%)! Isn’t it absurd that professionals define this as a highly risky investment?

This is how I think “risk” should be defined: The potential for losses.

That’s it!

Therefore, a risky investment has a high potential for losses. An example: a share of a single, unproven company in a politically and economically unstable country. A not risky investment has a low potential for losses – like a bank account.

************************************************************************************************************

This guest post was written by Ching, the founder of iMoney.my, a price comparison website for Malaysians. Ching is a CFA charter holder, and was formerly an investment consultant and wealth advisor.

Mostly Winners -- Two Losers

Now that the UVA crisis has passed it is easy to see that the ultimate outcome created winning positions for mostly everyone involved. Even Rector Helen Dragas emerged with strength and character in bowing to the inevitable return of President Teresa Sullivan. It is unfortunate that Mark Kington and Peter Kiernan remain on the outside looking in. Both Kington and Kiernan are outstanding alums and their contributions to the University in the past merit returning these two to positions of respect at their alma mater. I for one hope to see both Kington and Kiernan playing a major role at the University in the years ahead, as they have in the past.

There are a lot of messages in what has transpired in the past two weeks, but reflect for a moment on why the groundswell of support for Sullivan was so overwhelming. Sullivan did the little things well. She was kind and friendly. She sought out all parts of the University community. She expressed interest in everything that we do. These things count. It was difficult to see her ouster as warranted and to see the process as fair. Underneath it all, the personality and humility of Terry Sullivan were her best weapons. She disarmed the community and her opponents with her affable style.

One major loser was the Governor. He did nothing to stop this process and more than one insider openly mentioned the Governor as a major mover in the effort to unseat Sullivan. Insiders are well aware of the Governor's true, as opposed to stated, role in all of this and, in due time, the public will know as well.

Another major loser was the Wall Street Journal, whose editorial "Virginia Fracas" contains more inaccuracies per paragraph than anything I've ever read. Moreover, the overriding theme of the editorial is totally inaccurate -- that this was a battle between reform and anti-reform. Nothing could be further from the truth. Today's WSJ article is similarly misleading for readers unencumbered with the facts. The WSJ has embarrassed itself with its coverage of the Sullivan crisis and makes one wonder about its coverage of other issues.

Hopefully true reform, as opposed to rearranging deck chairs, can come to the University now that this drama has ended.

There are a lot of messages in what has transpired in the past two weeks, but reflect for a moment on why the groundswell of support for Sullivan was so overwhelming. Sullivan did the little things well. She was kind and friendly. She sought out all parts of the University community. She expressed interest in everything that we do. These things count. It was difficult to see her ouster as warranted and to see the process as fair. Underneath it all, the personality and humility of Terry Sullivan were her best weapons. She disarmed the community and her opponents with her affable style.

One major loser was the Governor. He did nothing to stop this process and more than one insider openly mentioned the Governor as a major mover in the effort to unseat Sullivan. Insiders are well aware of the Governor's true, as opposed to stated, role in all of this and, in due time, the public will know as well.

Another major loser was the Wall Street Journal, whose editorial "Virginia Fracas" contains more inaccuracies per paragraph than anything I've ever read. Moreover, the overriding theme of the editorial is totally inaccurate -- that this was a battle between reform and anti-reform. Nothing could be further from the truth. Today's WSJ article is similarly misleading for readers unencumbered with the facts. The WSJ has embarrassed itself with its coverage of the Sullivan crisis and makes one wonder about its coverage of other issues.

Hopefully true reform, as opposed to rearranging deck chairs, can come to the University now that this drama has ended.

Tuesday 26 June 2012

Harmony at UVA

The UVA Board of Visitors voted today 15-0 to return Teresa Sullivan to her post as President of the University. In a gesture of unity, the Board conducted a 15-0 vote of confidence for the Rector, Helen Dragas. Truly!

These are welcome actions and hopefully now the University can address the real issues that seemed to divide the President and the Board that, heretofore, had never surfaced at a Board meeting. It is time to talk about these things in the open and begin a much needed move to reform an ossified, bureaucratic institution, that is in much need of reform.

UVA, like other major American Universities, faces an uncertain future because, while costs have gone through the roof, the quality of education provided has stagnated. It is time to face these problems squarely and not pretend that all is well in academia. All is not well.

The UVA Board has corrected an egregious error and should be commended. Removing a sitting President, without so much as a meeting or a vote or even a discussion at a board meeting, could never provide the Sullivan removal with even a bare minimum figleaf of legitimacy.

Board member Hunter Craig was the real hero, fighting tirelessly to get the votes necessary to call a meeting to reconsider and then to follow up and ultimately create the conditions that would lead to a unanimous board vote to return Sullivan to her post. Together with Heywood Fralin, Craig's leadership has rescued UVA from the brink.

All in all...a good day for UVA!

These are welcome actions and hopefully now the University can address the real issues that seemed to divide the President and the Board that, heretofore, had never surfaced at a Board meeting. It is time to talk about these things in the open and begin a much needed move to reform an ossified, bureaucratic institution, that is in much need of reform.

UVA, like other major American Universities, faces an uncertain future because, while costs have gone through the roof, the quality of education provided has stagnated. It is time to face these problems squarely and not pretend that all is well in academia. All is not well.

The UVA Board has corrected an egregious error and should be commended. Removing a sitting President, without so much as a meeting or a vote or even a discussion at a board meeting, could never provide the Sullivan removal with even a bare minimum figleaf of legitimacy.

Board member Hunter Craig was the real hero, fighting tirelessly to get the votes necessary to call a meeting to reconsider and then to follow up and ultimately create the conditions that would lead to a unanimous board vote to return Sullivan to her post. Together with Heywood Fralin, Craig's leadership has rescued UVA from the brink.

All in all...a good day for UVA!

Strangled by Regulation

The American economy isn't going anywhere. Even a Supreme Court decision against the Obamacare mandate can't fix the absence of commercial and residential lending mandated by Dodd-Frank. American business is strangling under the heavy boot of government. Hiring is simply irrational given the political and regulatory environment.

The energy industry will do well and there will be technology shows of strength, but the broader economy is weighted down by regulatory red tape and bureaucratic mistrust of free enterprise. All of this bodes ill for the prospects of those seeking employment. All the rhetoric about inequality and taxing the rich simply reinforce all of the reasons why business has no interest in adding jobs.

Unless and until the political environment changes in the direction of free enterprise, the American economy will remain on its present course, sputtering along with no real sense of direction.

The energy industry will do well and there will be technology shows of strength, but the broader economy is weighted down by regulatory red tape and bureaucratic mistrust of free enterprise. All of this bodes ill for the prospects of those seeking employment. All the rhetoric about inequality and taxing the rich simply reinforce all of the reasons why business has no interest in adding jobs.

Unless and until the political environment changes in the direction of free enterprise, the American economy will remain on its present course, sputtering along with no real sense of direction.

A Learning Process

Normally, each morning I can't wait to read the Wall Street Journal's opinion pieces, hoping to learn more about news events that may not be captured in the regular news sources. Or, to get a point of view that you rarely see in mainstream media. This morning, I simply passed it by.

Somehow after the lies and misrepresentations in yesterday's WSJ editorial entitled "Virginia Fracas," I don't trust the WSJ any more. Virtually, every paragraph of the "VF" article was an apparently deliberate attempt to distort what is really happening at UVA to fit a narrow political agenda. Shame on WSJ. I doubt that I will have any interest in perusing the WSJ editorial page in the future. I simply don't think the WSJ can be trusted to be truthful when they have a political point to make.

You live and learn.

Somehow after the lies and misrepresentations in yesterday's WSJ editorial entitled "Virginia Fracas," I don't trust the WSJ any more. Virtually, every paragraph of the "VF" article was an apparently deliberate attempt to distort what is really happening at UVA to fit a narrow political agenda. Shame on WSJ. I doubt that I will have any interest in perusing the WSJ editorial page in the future. I simply don't think the WSJ can be trusted to be truthful when they have a political point to make.

You live and learn.

Monday 25 June 2012

Republicans Want To Own The Sullivan Ouster

The McDonnell forces, not content with a furious effort to control the upcoming board vote on Tuesday, to maintain the ouster of Sullivan, have now enticed the Wall Street Journal into one of the most astounding editorials in the paper's history. This editorial is so full of factual inaccuracies and outright distortions as to make you wonder about the facts cited in other editorials that the Journal runs. Read it in today's WSJ.

The conservative right is apparently vying to support Governor McDonnell's effort to claim credit for Sullivan's ouster. They are turning this into a right versus left controversy, even though the entire episode seemed to have been originally engineered by the left. But, maybe not. It is becoming increasingly clear that Governor McDonnell was in on this from the very beginning as the now-famous Darden email stated.

The McDonnell forces are pulling out all of the stops to control the vote to oust Sullivan and to keep the University in a state of turmoil for years to come. This will be the principal legacy of the McDonnell governorship. Far from his stated policy of "neutrality," the Governor and his team are doing everything in their power to remove Sullivan with finality. Such action will never, ever have the stamp of legitimacy.

As Gilmore did in years past, McDonnell is on a path to alienate his Republican base. Having worn out his welcome with Republicans, Gilmore found his political future in Virginia destroyed. His crushing defeat by Mark Warner was accomplished by a substantial number of Republicans voting for Democrat Warner. McDonnell is headed for the same future. He is systematically fighting the very people that elected him and he will find out, as Gilmore did, that his Republican base in Virginia is withering away.

It is not only the Board of Visitors that displays a remarkable lack of transparency. The Governor of Virginia should be honest and admit his role in the sacking of Sullivan. His team is fighting furiously, as I write this, to maintain her ouster. Why not be open about it instead of more hypocrisy?

New Fund: OSK-UOB Asian Income Fund

If you have a medium risk appetite and are seeking for an investment opportunity in the Asian region, you may want to take a close look at OSK-UOB Asian Income Fund, a balanced fund which was newly launched by OSK-UOB Investment Management Berhad on 5 June 2012.

The fund is a feeder fund that aims to provide income and capital growth over the medium to long term by investing in one target fund, i.e, the Schroder Asian Income (fund's inception date: 24 October 2011 and is denominated in Singapore Dollar), which primarily invests in Asian equities and Asian fixed income securities.

More about Schroder Asian Income

The Schroder Asian Income can invests in Asian high yield bonds (30% - 70%), Asian high dividend yielding equities (30% - 70%), cash (0% - 30%) or other asset classes (0% - 10%). Cash will be used if necessary to limit downside risk during adverse market conditions. Financial derivatives are also used to stabilize the portfolio of the fund by hedging the fund's exposure to foreign currency.This strategy allows the Schroder Asian Income to adjust its allocation according to the phases of the economic cycle to deliver more consistent returns.

Source: OSK-UOB Investment Management

Sunday 24 June 2012

A Reality Check from GASB

There are new rules coming out from the Government Accounting Standards Board (GASB) that will require public pension funds to recalculate their unfunded liability. The new rules still retain a "wishful thinking" component, but the new rules definitely move the calculations more toward reality and away from the current fantasy rules that public pension funds now use.

The bottom line issue is how to "value" the future payments that pension beneficiaries are expecting to receive. Current methods have absurdly low valuations on these future payments and, as a result, the employer contributions to these funds have always been absurdly inadequate. It has long been in the interest of politicians and board members to downplay the miserable funding status of these pension funds and to hope and pray that their inevitable blow-up will occur on someone else's watch.

Some states, Utah in particular, have dealt with these obligations in a straight forward fashion and enacted true reform of their public pension plans. Others, like Virginia, have enacted temporary band-aid solutions that mostly just obscure the true nature of the funding crisis.

Expect the usual knee-jerk response to the new GASB rules, which actually don't go far enough, from folks who fear that telling the truth about the true costs of these public pension plans would eviscerate the political support for the plans.

The bottom line issue is how to "value" the future payments that pension beneficiaries are expecting to receive. Current methods have absurdly low valuations on these future payments and, as a result, the employer contributions to these funds have always been absurdly inadequate. It has long been in the interest of politicians and board members to downplay the miserable funding status of these pension funds and to hope and pray that their inevitable blow-up will occur on someone else's watch.

Some states, Utah in particular, have dealt with these obligations in a straight forward fashion and enacted true reform of their public pension plans. Others, like Virginia, have enacted temporary band-aid solutions that mostly just obscure the true nature of the funding crisis.

Expect the usual knee-jerk response to the new GASB rules, which actually don't go far enough, from folks who fear that telling the truth about the true costs of these public pension plans would eviscerate the political support for the plans.

This is McDonnell's Decision

In a close vote on a state governing board, all eyes look to the Governor's mansion. If Sullivan is not reappointed, then it should be obvious to everyone what really happened here and who is responsible. Politicians change after they get elected. Their inner circle quickly descends to a small group of political hacks and the super rich. These folks usually have a very different agenda than the voters who elected the politicians and often are diametrically opposed to the views of the political party that the politician represents.

Members of governing boards, both governmental and corporate, usually have only one agenda -- to stay on the boards. Thus, they look to those who control reappointment in times of crisis. Not all, but most. Check the political contributions that board members make in the months leading up to a reappointment decision and you will find a clear pattern. This is human nature, not some evil conspiracy. That human nature is playing out now at the University of Virginia. Whether or not Sullivan is returned to the UVA presidency will come down to the votes of two or three key McDonnell allies. How they vote will tell all.

Members of governing boards, both governmental and corporate, usually have only one agenda -- to stay on the boards. Thus, they look to those who control reappointment in times of crisis. Not all, but most. Check the political contributions that board members make in the months leading up to a reappointment decision and you will find a clear pattern. This is human nature, not some evil conspiracy. That human nature is playing out now at the University of Virginia. Whether or not Sullivan is returned to the UVA presidency will come down to the votes of two or three key McDonnell allies. How they vote will tell all.

Saturday 23 June 2012

Whatever Happened to Due Process?

While noting that the ouster of President Sullivan was done without transparency and proper procedure, Virginia Governor McDonnell has decided to make up his own rules. He says that if no decision is reached by Wednesday, he will replace the entire Board of Visitors: "If you fail to do so, I will ask for the resignation of the entire Board on Wednesday."

What is the statutory requirement for the Governor to remove a Board member? The only grounds permitting the Governor to legally remove a Board member are "malfeasance, misfeasance, incompetence, or gross neglect of duty." There is nothing in the code of Virginia that says that disagreeing with the Governor constitutes grounds for dismissal. The Governor's threat, if carried out, changes the clear intention of the Virginia Code. It would permit any sitting Governor, any time they disagreed with a Board action, to simply remove the entire Board.

The Governor's behavior in all of this comes as no surprise. To quote an email dated June 12th in explaining the ouster of President Sullivan by the Board of Visitors and reprinted in full in the Charlottesville Daily Progress from someone who claimed in the email to be in the inner circle of all of this: "As many of you know no major decision of this kind can be made at Virginia without the support and assent of the Governor." Amen

What is the statutory requirement for the Governor to remove a Board member? The only grounds permitting the Governor to legally remove a Board member are "malfeasance, misfeasance, incompetence, or gross neglect of duty." There is nothing in the code of Virginia that says that disagreeing with the Governor constitutes grounds for dismissal. The Governor's threat, if carried out, changes the clear intention of the Virginia Code. It would permit any sitting Governor, any time they disagreed with a Board action, to simply remove the entire Board.

The Governor's behavior in all of this comes as no surprise. To quote an email dated June 12th in explaining the ouster of President Sullivan by the Board of Visitors and reprinted in full in the Charlottesville Daily Progress from someone who claimed in the email to be in the inner circle of all of this: "As many of you know no major decision of this kind can be made at Virginia without the support and assent of the Governor." Amen

Friday 22 June 2012

McDonnell Wades In

The Governor of Virginia has finally said something of substance about the ongoing tragedy at the University of Virginia. Apparently, the Governor finds fault with all parties and demands quick action. He will, he says, remove the entire Board of Visitors if they do not emerge from next Tuesday's Board meeting with a decision and an explanation and, interestingly, "unity."

One suspects that the Governor is not happy about the very fact of a called meeting to "reconsider" President Sullivan's employment. He would have preferred to "move on" with the new leadership. Never mind that nearly 100 percent of faculty, student and alums seem uncomfortable with the manner of Sullivan's ouster. The Governor seems to think that speed and decisiveness are the answer as opposed to due process and sound judgment.

The Board needs to make a decision one way or another. The Governor should have called upon the Board to meet and make a decision last week not this week. It boggles the mind that the Governor was perfectly happy last week to accept the ouster of a sitting President of the University of Virginia, when not a single member of the Board has voted for her removal.

The issue is mainly one of governance and due process. Whether or not a "unified" decision is reached Tuesday is less important than whether or not the process passes the smell test. The Governor seems to be expressing sour grapes that his plans seem to be getting derailed.

One suspects that the Governor is not happy about the very fact of a called meeting to "reconsider" President Sullivan's employment. He would have preferred to "move on" with the new leadership. Never mind that nearly 100 percent of faculty, student and alums seem uncomfortable with the manner of Sullivan's ouster. The Governor seems to think that speed and decisiveness are the answer as opposed to due process and sound judgment.

The Board needs to make a decision one way or another. The Governor should have called upon the Board to meet and make a decision last week not this week. It boggles the mind that the Governor was perfectly happy last week to accept the ouster of a sitting President of the University of Virginia, when not a single member of the Board has voted for her removal.

The issue is mainly one of governance and due process. Whether or not a "unified" decision is reached Tuesday is less important than whether or not the process passes the smell test. The Governor seems to be expressing sour grapes that his plans seem to be getting derailed.

Hopeful Signs at UVA

A meeting of the Board of Visitors of the University of Virginia has been scheduled for next Tuesday at 3PM for the express purpose of revisiting the ouster of Teresa Sullivan. BOV members Hunter Craig and Heywood Fralin spent the better part of the week lining up what they think are a majority of the BOV in support of returning Sullivan to her post. This is truly good news for the University and could spark a renewal of the sense of community that UVA has made its trademark.

While tempers have flared and some things have been said and done that one might wish had not, by and large, discourse between those who disagree has been remarkably civil. One hopes that if Sullivan is returned, then a process of healing can begin that would include olive branches to Helen Dragas, Marc Kington, and others who are seen as central figures in this drama. The University needs all of its alumni, not just those who might end up the winners in this tragedy. Forgiveness, reconciliation, and goodwill should be the goals of the returning administration and, from my observations of President Sullivan, I think she will lead the University in that direction when she returns to the presidency.

If there are "philosophical differences" about the future of the University, let's discuss them -- in the open and with candor. Future board meetings should be about real issues, not shunting the real disagreements off to private emails and behind the scenes conversations. We can disagree and still have a community. Let's try open discussion. No one has a monopoly on truth or vision. Let's explore online education. Set up a task force to look into this topic and let's begin a serious look at this issue and other issues that seemed to trigger the current crisis at the University.

The University could emerge a better place if President Sullivan is reinstated, if we begin to think seriously about how to improve governance, and if we forgive those with whom we disagree.

While tempers have flared and some things have been said and done that one might wish had not, by and large, discourse between those who disagree has been remarkably civil. One hopes that if Sullivan is returned, then a process of healing can begin that would include olive branches to Helen Dragas, Marc Kington, and others who are seen as central figures in this drama. The University needs all of its alumni, not just those who might end up the winners in this tragedy. Forgiveness, reconciliation, and goodwill should be the goals of the returning administration and, from my observations of President Sullivan, I think she will lead the University in that direction when she returns to the presidency.

If there are "philosophical differences" about the future of the University, let's discuss them -- in the open and with candor. Future board meetings should be about real issues, not shunting the real disagreements off to private emails and behind the scenes conversations. We can disagree and still have a community. Let's try open discussion. No one has a monopoly on truth or vision. Let's explore online education. Set up a task force to look into this topic and let's begin a serious look at this issue and other issues that seemed to trigger the current crisis at the University.

The University could emerge a better place if President Sullivan is reinstated, if we begin to think seriously about how to improve governance, and if we forgive those with whom we disagree.

Wednesday 20 June 2012

New Fund: PB Dynamic Allocation Fund

Another new fund for the month of June, Public Mutual launched PB Dynamic Allocation Fund which allows the investor the opportunity to participate in tactical asset allocation strategy where instruments are allocated between the difference asset classes of equities, fixed income securities and money market instruments based on a flexible investment mandate. The fund may capitalize on potential investment opportunities if the market outlook is positive while reducing its equity exposure when weakness in the equity markets is expected.

As such, its equity content may range between 30% to 98% of the NAV of the fund. The balance of the fund's NAV may be invested in fixed income securities and liquid assets which include money market instruments and deposits.

Investment Strategy

Although the fund is actively managed, the frequency of its trading strategy will very much depend on market opportunities. The fund employs both the top-down and bottom-up approach to evaluate its investments. For its equity investments, the fund will invest in a diversified portfolio of blue chip stocks, index stocks and growth stocks listed in domestic and selected foreign stock markets. In identifying such companies, the fund adopts the bottom-up approach which relies on fundamental research.The fund's investment may include listed warrants and options to enhance its returns. Also, it may consider investments in unlisted equities, particularly in companies that are expected to seek listing on the Bursa Securities or selected foreign markets within a time frame of 2 years.

Equity Linked Participation Notes?

More detail on equities, the fund may invest in equity linked participation notes for selected foreign stocks listed on the Luxembourg Stock Exchange. Equity linked participation notes are instruments designed to track designated securities. The movement of these notes are similar to the underlying shares listed in their respective markets.

Source: Public Mutual

Tuesday 19 June 2012

Wow!

The University of Virginia Board of Visitors laid down the gauntlet by naming McIntire Business School Dean Zeithaml as the "interim President." It is hard to see this appointment as anything but a thumb in the eye to the University faculty and student body, concerned that outside financial interests have taken over University governance. There was no vote taken on the resignation and/or termination of President Teresa Sullivan, avoiding the hard question of who does or does not support her removal, not to mention the haunting question of why. As has become normal operating procedure for this Board of Visitors, all relevant activity took place in secret under the cloak of "executive sessions," further arousing the suspicions of those who view all of this as a massive conspiracy.

This sets the stage for a protracted battle between virtually the entire University of Virginia community and the school's governing Board and raises serious questions about where future funding will come from, given recent statements from major donors. The idea that this will "soon blow over" is wishful thinking. The road ahead probably signals the decline of what once was one of the very top public universities in the country. Nothing good lies ahead as the cohesion required for a major institution to thrive has been ripped asunder.

Surprisingly, Governor McDonnell has decided to go with this outcome and he now earns the dubious distinction of being the Governor who, effectively by proxy, removed the first woman President in the history of the University of Virginia. I guess he wanted this mantle, otherwise he might have acted differently. I suspect he must know by now that Mitt Romney has no interest in adding him to his presidential run this year. Ironically, this entire episode could easily be enough of a political problem for Republicans to ensure an Obama victory in Virginia in this year's presidential election, even though Sullivan's removal seems to have been mainly orchestrated by two Board members first appointed by Democratic governors.

This sets the stage for a protracted battle between virtually the entire University of Virginia community and the school's governing Board and raises serious questions about where future funding will come from, given recent statements from major donors. The idea that this will "soon blow over" is wishful thinking. The road ahead probably signals the decline of what once was one of the very top public universities in the country. Nothing good lies ahead as the cohesion required for a major institution to thrive has been ripped asunder.

Surprisingly, Governor McDonnell has decided to go with this outcome and he now earns the dubious distinction of being the Governor who, effectively by proxy, removed the first woman President in the history of the University of Virginia. I guess he wanted this mantle, otherwise he might have acted differently. I suspect he must know by now that Mitt Romney has no interest in adding him to his presidential run this year. Ironically, this entire episode could easily be enough of a political problem for Republicans to ensure an Obama victory in Virginia in this year's presidential election, even though Sullivan's removal seems to have been mainly orchestrated by two Board members first appointed by Democratic governors.

Monday 18 June 2012

What is Bursa Malaysia Derivatives Local Participant?

Recently, Bursa Malaysia launched its Derivatives Local Participants Recruitment Drive to have more derivatives traders, so that a more vibrant and dynamic derivatives market can be seen in Malaysia. Anyway, what is it actually? I guess many of us, either yourself or investors or traders, also doesn't know the exact answer...

Again, it's time for Finance Malaysia to do Bursa Malaysia a favor to educate the public. A Local Participant (Locals) is a professional derivatives trader who trades for his/her own account. In essence, a self-employed trader. With the recent easing of entry requirements, those who aspire to be a Local Participant are not required to pass the licensing examination, show the relevant academic qualification and industry experience.

What is the benefits of being a Locals?

Locals have grown alongside the Exchange over the years, both in terms of numbers and trading participation in derivatives products. As a proprietary trader, they have unlimited trading potential. They trade as a business and have the option of working flexi-hours from anywhere. Locals also enjoy exchange fee rebates and tax abatement on their income such as below:- A Local Participant will enjoy exchange fee and clearing fee incentives if he trades 1,000 contracts per month or more.

- A Local Participant will receive a 50% tax abatement on income derived from derivatives trading.

What are the differences between the current and previous admission requirements of a Local Participant?

Effective 3 January 2012, the following admission requirements of a Local Participants have been removed :-

- Have passed an examination approved by BMDB or have been granted an exemption in respect thereof;

- Possess such qualification as approved by BMDB; and

- Possess sufficient and relevant trading experience.

In substitution of the above admission requirements, an applicant needs to attend a two-day familiarization programme conducted by BMDB.

What are the products offered by BMDB for Local Participants?

BMDB offers a range of derivatives products for Local Participants, which include the two (2) key products, namely, Crude Palm Oil Futures ("FCPO") and FTSE Bursa Malaysia KLCI Futures ("FKLI").

Source: www.bursamalaysia.com

UVA Board Facing a Tidal Wave

They should have seen this coming. Major large donors are now abandoning the UVA Board in its effort to defend its decision to sack President Terry Sullivan. The current Provost John Simon added his voice of protest to that of former President John Casteen over the board's yet-to-be-explained removal of Sullivan. More than 800 faculty, staff and onlookers convened quietly in the Darden School auditorium last night to watch the Faculty Senate endorse a resolution expressing "no confidence" in the University's Board. UVA's Student Honor Council weighed in with its own letter expressing views that can't be encouraging for the Board.

Who's left?

Within the next 24 hours, I would expect some major changes in board composition as well as some change of course by the Board itself in the Sullivan ouster episode. The Board simply does not have the horses at this point and it is time to sound the retreat. Having the authority to fire Sullivan is just not enough. There needs to be some buy-in somewhere for this action and, thus far, there isn't any. Look for some kind of capitulation today by the UVA Board. Only the Governor and his staff seem content with the current situation and that will change too when they finally wake up and smell the coffee.

Who's left?

Within the next 24 hours, I would expect some major changes in board composition as well as some change of course by the Board itself in the Sullivan ouster episode. The Board simply does not have the horses at this point and it is time to sound the retreat. Having the authority to fire Sullivan is just not enough. There needs to be some buy-in somewhere for this action and, thus far, there isn't any. Look for some kind of capitulation today by the UVA Board. Only the Governor and his staff seem content with the current situation and that will change too when they finally wake up and smell the coffee.

Saturday 16 June 2012

UVA Crisis Morphs Into a Political Issue

It's a great irony that two Democrats have created a growing problem for a Republican Governor. Both the Rector and Vice Rector (translate to Chairman and Vice Chairman) of the University of Virginia Board of Visitors (i.e. Directors) were first placed on the Board by Democratic governors. But Governor McDonnell has embraced both, reappointing one and quietly giving assurances of reappointing the other. So McDonnell will now be widely seen as responsible for their actions, even as he makes every effort to distance himself.

The problem is that the Rector and the Vice Rector have led the charge to remove one of the most popular university presidents in the country -- Terry Sullivan, until last week, President of the University of Virginia. Apparently, there is no constituency, outside of the Board of Visitors itself, that seems happy with Sullivan's dismissal. And, the Armada is assembling.

Strongly worded petitions are garnering signatures expressing a "lack of confidence" in the University's board from faculty, students, alumni groups, and the broader University of Virginia community.

The problem for the Board is a relatively simple one. No one outside the Board (and perhaps a wealthy citizen or two in Greenwich, Connecticut) seems to have any idea why the Rector and Vice Rector have taken the steps to remove President Sullivan -- and the Rector and Vice Rector aren't talking -- citing "confidentiality" issues that surround personnel decisions.

This bizarre situation permits discontented observers to dream up their own devil theory as to what happened, aided and abetted by strange emails from prominent donors claiming to be the devil themselves. So, how does it end? Well, it doesn't end.

Faculty and student groups live for opportunities like this and are licking their chops to begin the demonstrations, petitions, and calumny that will soon dominate the news output in Virginia. Why study and do research, when you can carry a sign?

My sense is that the Board is underestimating the degree of disruption that their enemies are capable of. I don't doubt the good intentions of both sides, but within a few days that won't matter anymore. For McDonnell, his legacy will be that he will remembered forever as the Governor who orchestrated the removal of the first woman President in University of Virginia history. Whatever McDonnell's true role may or may not have been in this drama, he will gradually be given the baton by those who write the history of this episode.

The problem is that the Rector and the Vice Rector have led the charge to remove one of the most popular university presidents in the country -- Terry Sullivan, until last week, President of the University of Virginia. Apparently, there is no constituency, outside of the Board of Visitors itself, that seems happy with Sullivan's dismissal. And, the Armada is assembling.

Strongly worded petitions are garnering signatures expressing a "lack of confidence" in the University's board from faculty, students, alumni groups, and the broader University of Virginia community.

The problem for the Board is a relatively simple one. No one outside the Board (and perhaps a wealthy citizen or two in Greenwich, Connecticut) seems to have any idea why the Rector and Vice Rector have taken the steps to remove President Sullivan -- and the Rector and Vice Rector aren't talking -- citing "confidentiality" issues that surround personnel decisions.

This bizarre situation permits discontented observers to dream up their own devil theory as to what happened, aided and abetted by strange emails from prominent donors claiming to be the devil themselves. So, how does it end? Well, it doesn't end.

Faculty and student groups live for opportunities like this and are licking their chops to begin the demonstrations, petitions, and calumny that will soon dominate the news output in Virginia. Why study and do research, when you can carry a sign?

My sense is that the Board is underestimating the degree of disruption that their enemies are capable of. I don't doubt the good intentions of both sides, but within a few days that won't matter anymore. For McDonnell, his legacy will be that he will remembered forever as the Governor who orchestrated the removal of the first woman President in University of Virginia history. Whatever McDonnell's true role may or may not have been in this drama, he will gradually be given the baton by those who write the history of this episode.

Friday 15 June 2012

The Ultimate Destination of "Affordable Health Care"

Greece was the model -- a national health care system that was both affordable and universal. Candidate Obama chided Americans for being the only developed country in the world unwilling to provide "affordable" health care. We now see where the "Affordable Health Care Act" is taking us.

Karolina Tagaris spells it out in a special Reuters report today:

"Greece's rundown state hospitals are cutting off vital drugs, limiting non-urgent operations and rationing even basic medical materials for exhausted doctors as a combination of economic crisis and political stalemate strangle health funding."

The 'rundown state hospitals' did not become rundown overnight. It took some time to destroy the medical system in Greece, but we are there now. I wonder if no health care is better than free market health care. Greece is about to find out.

What is the lesson? Contrary to Candidate Obama's loose talk, no nation can 'afford' "Affordable Health Care." You get what you pay for. If no one pays, eventually no one gets.

Karolina Tagaris spells it out in a special Reuters report today:

"Greece's rundown state hospitals are cutting off vital drugs, limiting non-urgent operations and rationing even basic medical materials for exhausted doctors as a combination of economic crisis and political stalemate strangle health funding."

The 'rundown state hospitals' did not become rundown overnight. It took some time to destroy the medical system in Greece, but we are there now. I wonder if no health care is better than free market health care. Greece is about to find out.

What is the lesson? Contrary to Candidate Obama's loose talk, no nation can 'afford' "Affordable Health Care." You get what you pay for. If no one pays, eventually no one gets.

New Fund: AmConsumer Select - Capital Protected

AmInvestment Bank is launching a new capital-protected fund and it is optimistic of a good take-up rate for this RM100mil new fund. According to its CEO, the launch of the fund is timely in view of the current macroeconomic uncertainties. Since it is capital protected, the fund offers a safe haven for risk-averse investors looking to hedge against the uncertainty in the global market, she adds.

The Fund is a close-ended fund which aims to provide regular income with an investment horizon of 2.5 years (30 months) whilst providing capital protection on Maturity Date. The Fund seeks to achieve its objective by investing in ZNIDs and/or MGS and an over-the-counter option linked to the price movement of a basket of five (5) consumer related stocks.

For the purpose of the Fund, consumer related stocks refer to stocks of companies that produce products/services that are consumed by individuals. Selection of consumer related stocks is based on fundamental strength of the companies through internal research and brands that the Manager considers to be widely known among investors.

The Strategy...

Generally, the Fund will adopt a two-fold strategy to achieve its objective, i.e.

- Capital protection* from fixed income portionAt the Fund’s commencement, a minimum of 85% of the Fund’s NAV will be invested in 2.5-year ZNIDs and/or MGS with shorter or similar maturity tenure to the Fund’s maturity, which upon maturity of the Fund will achieve an amount equivalent to 100% of investor’s initial capital (which includes entry charge payable by investors). A maximum of 5% of the Fund’s NAV will be maintained in cash and/or money market instruments for liquidity purposes.

- Fund’s return from option portionAt the Fund’s commencement, up to 10% of the Fund’s NAV will be used to purchase a 2.5-year USD denominated option with an option counter-party, which is a financial institution carrying a minimum long-term rating of “A” by S&P or the equivalent rating by any other global rating agency. The option provides exposure which is linked to the price movement of a basket of five (5) consumer related stocks.

At the end of each quarter, if the closing price of each of the stock is at or above its respective initial level on any day within the quarter, the option counter-party pays a conditional coupon. The income distribution (if any) will however be paid half yearly to investors.

The basket of five (5) consumer related stocks (indicative selection only) currently identified as

follows:

If the Coupon Payout Condition is met at any quarter, the coupon payout from the option

counterparty is calculated as follows:

Coupon (RM) = (Notional Amount / USD/RMInitial) x coupon rate (settled in USD) x

USD/RMEnd

- “USD/RMInitial” refers to the USD/RM exchange rate for the determination of the Notional Amount in USD as at Commencement Date.

- “USD/RMEnd” refers to the actual USD/RM exchange rate for conversion of the coupon (received by the Fund) from USD to RM.

* Investors are advised that the Fund is not a guaranteed fund. Capital protection is provided through investments in ZNIDs and/or MGS and not by a guarantee. Consequently, the return of capital is SUBJECT TO the credit/default risk of the issuers of the ZNIDs and/or MGS and may result in losses.

Source: AmMutual

Thursday 14 June 2012

The Greek Vote Doesn't Matter

The only sense in which the Greek election on Sunday matters is as a time marker. Whoever wins cannot possibly follow through on the austerity program and, regardless of the outcome, Greek is headed for a Euro exit. It's just numbers now. Greece is gone.

The real news is what is happening in Spain and Italy. Yields on sovereign debt are rising quickly in both countries. They are past the point at which either country has any real shot at making it through this. Germany does not have the resources to rescue the situation, nor does the US and/or Britain. It is over for the Eurozone.

The failure to permit workouts and bankruptcy, which is what should have happened here, as well as in the US in 2008, is going to exact a huge price on the Eurozone. Massive unemployment, surging inflation, and collapsing GDP represent Europe's near term future. It is really far too late now to avoid catastrophe.

Hopefully, other countries will learn something from Europe's coming agonies. States like California, Illinois, New Jersey and Maryland are heading down the path to insolvency and quickly. The US national fiscal situation probably has a two to three year window left within which to tackle it's enormous debt problems. We shall see if anyone learns or if we are simply destined to follow Europe down the road to disaster.

Honesty and transparency would solve these problems. Pretending that there is some other fix by politicians guarantees economic and political chaos.

The real news is what is happening in Spain and Italy. Yields on sovereign debt are rising quickly in both countries. They are past the point at which either country has any real shot at making it through this. Germany does not have the resources to rescue the situation, nor does the US and/or Britain. It is over for the Eurozone.

The failure to permit workouts and bankruptcy, which is what should have happened here, as well as in the US in 2008, is going to exact a huge price on the Eurozone. Massive unemployment, surging inflation, and collapsing GDP represent Europe's near term future. It is really far too late now to avoid catastrophe.

Hopefully, other countries will learn something from Europe's coming agonies. States like California, Illinois, New Jersey and Maryland are heading down the path to insolvency and quickly. The US national fiscal situation probably has a two to three year window left within which to tackle it's enormous debt problems. We shall see if anyone learns or if we are simply destined to follow Europe down the road to disaster.

Honesty and transparency would solve these problems. Pretending that there is some other fix by politicians guarantees economic and political chaos.

Unrest Grows at UVA

The University of Virginia is in crisis. There can't be any doubt about it. There seems to be remarkable unity among those who question the Board of Visitor's recent decision to request the resignation of UVA President Teresa Sullivan. I suspect part of that unity is fed by the personality that Sullivan exposed to the community during her two year tenure at the University. Sullivan exudes happiness and optimism and seemed to immerse herself in all aspects of UVA from the moment of her arrival.

With a history of experience with very large universities and a research background in sociology, Sullivan's selection in 2010 was initially widely viewed with skepticism by many parts of the University community -- me included. But Sullivan took steps to meet and greet with all parts of her constituency and soon became a familiar and welcome figure around grounds. She held meetings with different employee groups, gave frequent talks in small settings, engaged groups that had never been engaged by a UVA President before, and was regularly seen cheering on UVA athletic teams, often alone without the usual entourage that accompanies the University's highest ranking employee.

In short, Sullivan is a very engaging and pleasant person who appeared to genuinely like the University and made herself visible in an apparent effort to reassure the restless that she would do what she could to make UVA a better place. That has left a residue of goodwill for Teresa Sullivan that the Board of Visitors is going to have a tough time dissipating.

One of the discouraging features of the current public relations debacle is that board minutes do not exhibit any disagreement between Sullivan and the Board over University policy, strategy or vision. If there are "philosophical differences," then these differences should play out at Board meetings. UVA is a public institution and the idea behind the legal requirement for open and public meetings is that policy differences should be aired publicly. One of the bizarre features of the current crisis is that, even now, no one seems to really know what these "philosophical differences" were.

Devil theories abound about why we are where we are, but the truth is more likely that all concerned are trying to do the right thing and genuinely believe the actions they have taken are the correct ones. I would not buy in to the view that this is some sort of conspiracy at work. A conspiracy would have handled matters very differently than the strange pattern of events that we are witnessing. It is far more likely that things weren't thought through adequately and well-intentioned people misread the reaction that would accompany their efforts to improve UVA's future.

But, we are where we are and this is not going away. It may sound like a ridiculous pipedream, but I would hope that Sullivan can be persuaded to return with perhaps a more formal mandate from the Board and the Board can begin a process to begin to adopt a strategic plan and vision that it feels is appropriate. Then if "differences" remain, the Board can take whatever action it feels is appropriate. Both sides in this fiasco can "win" something if this is handled openly. Absent some kind of good faith effort to reconcile the current differences between the UVA Board and the greater University community, I am afraid that the current conflict could escalate in directions that the Board may not now envision.

With a history of experience with very large universities and a research background in sociology, Sullivan's selection in 2010 was initially widely viewed with skepticism by many parts of the University community -- me included. But Sullivan took steps to meet and greet with all parts of her constituency and soon became a familiar and welcome figure around grounds. She held meetings with different employee groups, gave frequent talks in small settings, engaged groups that had never been engaged by a UVA President before, and was regularly seen cheering on UVA athletic teams, often alone without the usual entourage that accompanies the University's highest ranking employee.

In short, Sullivan is a very engaging and pleasant person who appeared to genuinely like the University and made herself visible in an apparent effort to reassure the restless that she would do what she could to make UVA a better place. That has left a residue of goodwill for Teresa Sullivan that the Board of Visitors is going to have a tough time dissipating.

One of the discouraging features of the current public relations debacle is that board minutes do not exhibit any disagreement between Sullivan and the Board over University policy, strategy or vision. If there are "philosophical differences," then these differences should play out at Board meetings. UVA is a public institution and the idea behind the legal requirement for open and public meetings is that policy differences should be aired publicly. One of the bizarre features of the current crisis is that, even now, no one seems to really know what these "philosophical differences" were.

Devil theories abound about why we are where we are, but the truth is more likely that all concerned are trying to do the right thing and genuinely believe the actions they have taken are the correct ones. I would not buy in to the view that this is some sort of conspiracy at work. A conspiracy would have handled matters very differently than the strange pattern of events that we are witnessing. It is far more likely that things weren't thought through adequately and well-intentioned people misread the reaction that would accompany their efforts to improve UVA's future.

But, we are where we are and this is not going away. It may sound like a ridiculous pipedream, but I would hope that Sullivan can be persuaded to return with perhaps a more formal mandate from the Board and the Board can begin a process to begin to adopt a strategic plan and vision that it feels is appropriate. Then if "differences" remain, the Board can take whatever action it feels is appropriate. Both sides in this fiasco can "win" something if this is handled openly. Absent some kind of good faith effort to reconcile the current differences between the UVA Board and the greater University community, I am afraid that the current conflict could escalate in directions that the Board may not now envision.

Wednesday 13 June 2012

Chaos Ahead and Soon

The Greeks will vote on Sunday. The election is probably going to install a far(ther) left political party that intends to renounce the austerity program that has been forced upon them by their richer European neighbors. That means the end of the Euro for Greece. Greece will then descend into utter chaos and likely political anarchy. If you were plotting a visit to the Acropolis this summer, it might be best to seek a refund before its too late.

So, Greece will be gone. Then what? Spain and Italy are already gone, but no one is yet willing to admit it. Yields on 10 year government debt in both Spain and Italy are rapidly moving to the 7 percent level. At debt levels of more than 120 percent of GDP (that's Spain's debt level, if you correct for last week's bailout), Spain and Italy are now past the point of no return. Their debt levels are not sustainable. It's over for Spain and Italy.

Meanwhile, check out Germany's situation. The impact of the bailout adds debt on Germany's plate of nearly 40% of their GDP. That puts Germany in a perilous situation. Even though Germany's economy is still puttering along, their debt is rapidly moving toward the unsustainable level and, in truth, is not far behind Spain and Italy. So, Germany is toast as well. Is it worth analyzing the situation in France, which is not really much different now than the situation in Spain or Italy?

The whole house of cards is coming down and Act one of our chaotic future begins next week in Greece. All of this has been predictable; all of this was completely avoidable. To repeat the most recurrent theme of this blog: the modern welfare state is not affordable. There is no set of taxes, bond sales, or anything else that can provide the majority of any country's citizenry free goods and services at the expense of an ever-dwindling number of productive citizens. It is not a question of left or right wing politics or absence of political leadership. It is simply a question of arithmetic.

The lesson to be learned is that if no one is responsible for their own education, health care retirement, housing or anything else, then there will, in time, not be anyone left to produce these goods and services. "Taxing the rich" is the last refuge of the demagogue. Once you hear this theme, you know the game is over.

It doesn't really matter whether Obama wins or loses the election in November. The US is on the same trajectory as Europe and the ultimate outcome will be the same as what is now unfolding in Europe. Until the US body politic is willing to unwind the welfare state, eliminate bureaucratic rigidities to the free market, and face the fact that accumulation of wealth by individuals is a crucial and indispensable component of economic growth, then there is no avoiding the predictable outcome of the collapse of the modern welfare state.

So, Greece will be gone. Then what? Spain and Italy are already gone, but no one is yet willing to admit it. Yields on 10 year government debt in both Spain and Italy are rapidly moving to the 7 percent level. At debt levels of more than 120 percent of GDP (that's Spain's debt level, if you correct for last week's bailout), Spain and Italy are now past the point of no return. Their debt levels are not sustainable. It's over for Spain and Italy.

Meanwhile, check out Germany's situation. The impact of the bailout adds debt on Germany's plate of nearly 40% of their GDP. That puts Germany in a perilous situation. Even though Germany's economy is still puttering along, their debt is rapidly moving toward the unsustainable level and, in truth, is not far behind Spain and Italy. So, Germany is toast as well. Is it worth analyzing the situation in France, which is not really much different now than the situation in Spain or Italy?

The whole house of cards is coming down and Act one of our chaotic future begins next week in Greece. All of this has been predictable; all of this was completely avoidable. To repeat the most recurrent theme of this blog: the modern welfare state is not affordable. There is no set of taxes, bond sales, or anything else that can provide the majority of any country's citizenry free goods and services at the expense of an ever-dwindling number of productive citizens. It is not a question of left or right wing politics or absence of political leadership. It is simply a question of arithmetic.

The lesson to be learned is that if no one is responsible for their own education, health care retirement, housing or anything else, then there will, in time, not be anyone left to produce these goods and services. "Taxing the rich" is the last refuge of the demagogue. Once you hear this theme, you know the game is over.

It doesn't really matter whether Obama wins or loses the election in November. The US is on the same trajectory as Europe and the ultimate outcome will be the same as what is now unfolding in Europe. Until the US body politic is willing to unwind the welfare state, eliminate bureaucratic rigidities to the free market, and face the fact that accumulation of wealth by individuals is a crucial and indispensable component of economic growth, then there is no avoiding the predictable outcome of the collapse of the modern welfare state.

Monday 11 June 2012

IPO: Gas Malaysia

Gas Malaysia Berhad (GMB) was established to sell, market and distribute natural gas and Liquefied Petroleum Gas (LPG). GMB is also responsible for the construction and operation of the Natural Gas Distribution System (NGDS), which is a system comprising 1,800km of gas pipelines and stations within Peninsular Malaysia owned by GMB. NGDS is connected to the Peninsular Gas Utilisation (PGU), which is the gas transmission pipeline across Peninsular Malaysia owned and operated by PGB.

GMB’s core business to sell, market and distribute natural gas to industrial, commercial and residential customers in Peninsular Malaysia via NGDS. In other words, GMB purchases natural gas from PGB and sells to GMB’s own customers at a profit margin. There are currently two players in Peninsular Malaysia’s natural gas distribution industry, comprising GMB and PGB. However, both serve different sets of customers, whereby GMB’s customer base consists of users that initially consume less than 2 MMScfd, whereas PGB supplies to PETRONAS customers consuming more than 2 MMScfd. Customers that initially consume less than 2MMScfd but subsequently increase their consumption exceeding 2MMScfd will remain as GMB’s customers.

Like a toll road?

Looking at it from a slightly different perspective, GMB’s business can be compared to that of PLUS i.e. a toll road operator. Basically, consider GMB’s pipeline infrastructure as a highway, while the “toll” is GMB’s absolute gross margins, i.e RM2.02-2.25, while the “cars” represent the volume of natural gas supplied to GMB’s customers. We believe this comparison is fair, as GMB does not bear the risk of volatile natural gas prices as it buys and sells natural gas at regulated prices. As such, further growth in GMB’s sales volume would further improve its economies of scale given that other costs are largely fixed administrative costs.In February 2012, GMB signed a New Gas Supply Agreement (NGSA) with Petronas whereby effective from 1 January 2013, the maximum limit for GMB to supply to its customers individually will increase from 2 MMScfd to 5 MMScfd. The NGSA has a 10-year tenure with an option to extend for an additional 5 years. In addition, GMB also supplies LPG to consumers in Peninsular Malaysia.

Strong cash pile, 100% dividend payout for FY12. Management indicated that it will spend RM140-RM150m in FY12 for the expansion of GMB’s Natural Gas Distribution System and RM40m p.a. in both FY13 and FY14 for maintenance purposes. We think that it is possible for CAPEX to be funded internally, judging from the group’s huge cash pile of RM327m and retained earnings of RM360m as of Dec 2011. Besides, GMB is also committed to paying out 100% of its FY12 net earnings as dividends and it is targeting a minimum payout ratio of 75% from FY13 onwards.

Source: TA Securities, OSK Research, RHB Research Institute

UVA's Sullivan Steps Down

With a little nudge from the University's Board of Visitors, University of Virginia President Teresa Sullivan resigned yesterday after not quite two years in office. Few know, in any real detail, why Sullivan was eased out so early in her tenure, but the background noise suggests the usual headaches.

Money and its allocation form the main issues in the modern University. Elaborate fund raising operations have grown up in the modern elite schools, a group in which UVA claims membership. Athletic programs have profitability issues front and center. Witness the reshuffling of athletic conferences, which is completely driven by monetary issues. Compensation for administrators and successful fund raisers far exceed their equivalents in the private sector. Meanwhile, the education quality at elite schools has eroded dramatically over the past four decades. The only measure that seems to be improving in the elite schools in the US is the quality of the incoming student. By any other measure, American universities are on the decline.

The biggest problem is that of governance. Who should run a University? Students, faculty, administrators, taxpayers, boards, and alumni all seem to think they should be in charge. Typical of private foundations or state-run institutions, the "stakeholder" theory of governance is in charge, which means that no one is in charge. Worse, there is a community of interest between students and faculty to diminish the actual effort put into education. Faculty want to teach less and students would like more leisure time. This conspiracy has dramatically reduced teaching hours, classroom hours, and studying time over the last few generations.

Meanwhile, numerous political agendae have invaded the University community and it's budget. Centers have proliferated that seem to have no real purpose but to create political activism among the student body. These centers are very expensive, are constantly expanding, and serve no real educational purpose. Worse, many students devote their time to "activism" to the neglect of their education. Many students graduate thinking they are headed out to perform great public service, with sociology and anthropology degrees in hand. Who hires this group?

The burgeoning cost of higher education has created a mountain of debt for graduating seniors, and for many who never graduate. These costs are largely the result of the shift in focus in the modern University away from education toward social activities, political activities, and the promotion of semi-professional athletic programs. The actual education process is absurdly inexpensive, but actual educational expenses have been a declining part of University budgets since the early 1960s.