Who among the various candidates, Democratic or Republican, truly believes that economic scarcity is best solved by free markets? Indeed!

It is not clear that any of the candidates now running for the Republican nomination, other than Ron Paul, have any real faith in free market solutions to the problems of economic scarcity. No one is really proposing returning to free market principles. The battle ground seems much narrower -- personal and business tax rates, minor amendations to Obamacare, support for the Keystone project -- but not much else really.

The most likely outcome is a Romney candidacy. As much as that will be presented as the free market alternative to President Obama, in truth there is not much daylight between Romney and Obama. Neither seem to understand the fundamental economic malaise of modern America, nor to understand the root cause. One way you can tell that neither "get it" is the constant China-bashing that comes from the White House and the campaign trail.

Anybody that thinks China is at the heart of our economic stagnation believes in a fantasy. China is not the culprit. China is doing the right thing for its people by creating the largest expansion in free markets in the history of the world. The result -- economic prosperity for hundreds of millions of people who lived in subjection and poverty a mere generation ago.

What has the West accomplished in the last couple of generations? Growth of government mainly and a declining status of the middle class whose savings rate has collapsed to zero in the US and whose work ethic has slipped into the mud. Absent a savings rate and a work ethic, no amount of government waste will pull the US out of its malaise.

So, who speaks up for free markets. Sadly, no one except Ron Paul and he's not on a path to the White House, given his isolationist outlook on foreign policy.

Tuesday 31 January 2012

Monday 30 January 2012

BNM Further Liberalisation on Forex (Jan 2012)

As part of continuous efforts by Bank Negara Malaysia to enhance competitiveness in the economy and to develop the domestic financial markets, Bank Negara Malaysia wishes to announce the following liberalisation measures, with effect from 31 January 2012:

- To further spur the domestic foreign exchange market through greater product innovation, licensed onshore banks are permitted to trade foreign currency against another foreign currency with a resident.

- To further deepen the domestic interest rate derivatives market, a licensed onshore bank is allowed to offer ringgit-denominated interest rate derivatives to a non-bank non-resident.

- Towards enhancing the asset liability management of residents, flexibility is permitted for a resident to convert their existing ringgit or foreign currency debt obligation into a debt obligation of another foreign currency.

The above measures which are in line with the broad thrust of the Financial Sector Blueprint will contribute towards increasing the liquidity, depth and participation of wider range of players in the domestic financial markets.

Frequently Asked Questions:

- Can a resident buy and sell foreign currency against another foreign currency for any purpose?

- Yes. With this liberalisation, a resident is allowed to buy and sell foreign currency against another foreign currency for any purpose including for trading. However, such transactions shall only be undertaken with a licensed onshore bank.

- Does the liberalisation include trading of foreign currency against ringgit?

- No. The liberalisation is only for transactions involving foreign currency against another foreign currency for any purpose.

- What are the prevailing rules on investment in foreign currency assets?

- Who are the licensed onshore banks?

- licensed commercial banks in Malaysia;

- licensed Islamic banks in Malaysia; and

- licensed investment banks in Malaysia.

- What are the prevailing rules on foreign currency credit facilities obtained by a resident?

For further information and enquiries on the measures, members of the public may contact Bank Negara Malaysia via Toll free line : 1 300 88 5465 (BNMTELELINK)

Source: BNM website

Sunday 29 January 2012

Obama Is Right on Tuition Levels

In his State of the Union address last week, the President put forth an idea that is a long time in coming. Federal government aid should be curtailed to schools whose tuition is going through the roof and redirected toward schools who are running a tight ship. Amen.

In the past, the answer to the surging costs of higher education was to throw more money at higher education through more federal dollars and increasing loan availability to students. All this did was feed the beast and have universities searching for ways to toss money down ratholes. Meanwhile, millions of our college graduates are now saddled with debts that they have no hope of ever coming out from under. All of this to fatten the ever bloated monstrosity that is known as higher education.

Higher education is one of the few areas of American life, where there has been no serious change in technology implementation. Most schools still run their classroom in the same old way -- blackboard, chalk and someone droning on in the front of a mostly empty classroom. While there is technology available in abundance, it lies mostly unused at the modern American university. Facebook gets more action from University students than any websites that provide serious educational offerings.

Obama is on the right track on this one. Higher education costs are completely out of control. The priorities in the modern American university are less about educating students and improving skills and more about advancing the narrow political agenda of university faculty and administrations. The losers are taxpayers and students.

Three cheers for the President.

In the past, the answer to the surging costs of higher education was to throw more money at higher education through more federal dollars and increasing loan availability to students. All this did was feed the beast and have universities searching for ways to toss money down ratholes. Meanwhile, millions of our college graduates are now saddled with debts that they have no hope of ever coming out from under. All of this to fatten the ever bloated monstrosity that is known as higher education.

Higher education is one of the few areas of American life, where there has been no serious change in technology implementation. Most schools still run their classroom in the same old way -- blackboard, chalk and someone droning on in the front of a mostly empty classroom. While there is technology available in abundance, it lies mostly unused at the modern American university. Facebook gets more action from University students than any websites that provide serious educational offerings.

Obama is on the right track on this one. Higher education costs are completely out of control. The priorities in the modern American university are less about educating students and improving skills and more about advancing the narrow political agenda of university faculty and administrations. The losers are taxpayers and students.

Three cheers for the President.

Any Hidden Agenda Behind the Sales of POS and PROTON?

Lately, there was a slew of divestment by Khazanah Nasional Bhd (Investment arm of Malaysia Government). And, the most recent one was the divestment of Proton stakes to DRB-Hicom. But, the strange part was DRB-Hicom was the winning bidder for Khazanah's stake in POS Malaysia last year too.

Questions have been pouring in to Finance Malaysia regarding this issue, such as, are there any linkages between the two national deals? Other than DRB-Hicom, there was none other better suitors? As such, we would like to give our opinion on this matter. (Just for your reading pleasure)

You have the Questions, We have the Answers

First, both POS and Proton were considered as "sunset" companies in their respective industry. Both were not managed well and fallen from their glamorous days. Just as many investors written them off from investment radar, DRB-Hicom comes into the picture. Frankly speaking, the only asset both companies have was Government's backing.While POS has the monopoly status in its services, Proton being the national car maker was trying to monopolize too by merging with Perodua. It's been a hot debate on whether Proton and Perodua should merge for better synergies. Anyway, we think that they should remain status quo to creates a healthy competition for consumers benefits.

|

| Idea of the year: Combining POS and Proton via Stamp? |

Where is the money comes from?

Another question was on the financial soundness of DRB-Hicom to acquires both companies. We as investors knows that DRB-Hicom does not have much cash in hand (even after excessive borrowing). The 32.21% stake at RM3.60 per share in POS costing RM622.79mil. Then, how about the Proton stake which amounted to over RM1bil? It's like a snake swallowing a cow, then a buffalo within few months!!! Can you imagine?

Any Hidden Agenda?

After all this, Finance Malaysia comes out with a guessing questions on the two deals between DRB-Hicom and Khazanah. Anything to do with the upcoming general election? (Seems like everything was linked to GE nowadays) Does the Government scared of losing the next general election and preparing to divest some of its assets first? Then, to whom they should divest to? Of course, their allies, right? DRB-Hicom?

But, what if they won again and POS and Proton was sold? No worry, because their good ally will always be able to sell it back to them (potentially with good investment gains too). Then, Khazanah can re-list again both POS and Proton proudly. Is this the case?

Well, we're guessing only. And, once again, this is for your reading pleasure only. Don't take it seriously. Happy Guessing.

Saturday 28 January 2012

The New Normal in the Obama Economy

Peter Whoriskey's article in today's Washington Post gives a brief summary of the "Obama Recovery" and it's not pretty. The slowest economic recovery in post World War II history has left the economy, even at this late date, with 6 million fewer jobs than it had before Obama took office. This after the most incredible expansion in federal spending and the national debt in American history. Quite a record!

The article shows who are the winners and who are the losers. The winners are businesses, who no longer intend to carry the albatross of the American worker. Loaded up with government mandates, rights, privileges, benefits, and lawyers, the American worker is a luxury that American businesses are determined to wean themselves away from.

"Businesses are swiftly investing in equipment and software. Those investments were up 5 percent in the last quarter of 2011 and 16 percent the quarter before that...."

As for the middle class that Obama claims to be defending: " disposable personal income is slightly lower, in inflation-adjusted dollars, than it was a year earlier."

That's the report card for big government. The rich and powerful do fine in the Obama economy. But, everyone else is in big trouble.

The article shows who are the winners and who are the losers. The winners are businesses, who no longer intend to carry the albatross of the American worker. Loaded up with government mandates, rights, privileges, benefits, and lawyers, the American worker is a luxury that American businesses are determined to wean themselves away from.

"Businesses are swiftly investing in equipment and software. Those investments were up 5 percent in the last quarter of 2011 and 16 percent the quarter before that...."

As for the middle class that Obama claims to be defending: " disposable personal income is slightly lower, in inflation-adjusted dollars, than it was a year earlier."

That's the report card for big government. The rich and powerful do fine in the Obama economy. But, everyone else is in big trouble.

Thursday 26 January 2012

The Obama Plan to Lower Tax Revenues

The so-called "Buffett-Rule," which would impose a minimum tax on incomes above $ 1 million, would guarantee lower tax revenues for the US Treasury. Folks with high income would simply choose to lower their taxable income. That is a fairly simple thing to do and always happens when you raise tax rates on wealthy citizens. Short of confiscating folk's wealth, something Obama may get around to eventually, raising tax rates just encourages tax lawyers and leverage (the wealthy borrow more to live and let their assets grow unrealized...that solves the problem of lowering your taxable income without affecting your lifestyle).

Meanwhile, as tax revenues collapse, the Obama folks will find a way to tack on a tax increase for the middle class to offset the revenue loss from rich folks. This is always the route that tax rate increase advocates end up taking. The result: the middle class gets soaked with more taxation, while the no-nothings revel in the irrelevant higher rate structure that wealthy folks face, but do not pay. This is the kind of absurdity that Obama's class warfare will lead to. No wonderrich people support higher tax rates. Buffett knows he will pay less under Obama's soak-the-rich tax than he does now, so why worry? (Once the new rates are passed, Buffett will lob a call into his high priced tax attorney and get the advice he needs to pay less taxes under the Obama plan than he pays now. Don't think he won't make that call. He will).

Meanwhile, higher marginal rates will mean that money that would have flowed into the capital markets to create new businesses and new jobs will lie dormant in frozen assets. High levels of unemployment, economic stagnation and increasing misery for the poor, minorities and old folks will be the Obama legacy. This is what happens when economic policy is an outgrowth of coffee-house conversations at Harvard by people who have never held a real job.

Meanwhile, as tax revenues collapse, the Obama folks will find a way to tack on a tax increase for the middle class to offset the revenue loss from rich folks. This is always the route that tax rate increase advocates end up taking. The result: the middle class gets soaked with more taxation, while the no-nothings revel in the irrelevant higher rate structure that wealthy folks face, but do not pay. This is the kind of absurdity that Obama's class warfare will lead to. No wonderrich people support higher tax rates. Buffett knows he will pay less under Obama's soak-the-rich tax than he does now, so why worry? (Once the new rates are passed, Buffett will lob a call into his high priced tax attorney and get the advice he needs to pay less taxes under the Obama plan than he pays now. Don't think he won't make that call. He will).

Meanwhile, higher marginal rates will mean that money that would have flowed into the capital markets to create new businesses and new jobs will lie dormant in frozen assets. High levels of unemployment, economic stagnation and increasing misery for the poor, minorities and old folks will be the Obama legacy. This is what happens when economic policy is an outgrowth of coffee-house conversations at Harvard by people who have never held a real job.

Wednesday 25 January 2012

More Politics from Obama

The state of the union speech revealed a complete lack of interest in the absence of growth in the US economy on the part of the President. This means that lower income folks can expect their misery to continue as long as this President remains in office.

Instead the President launched a variety of attacks against his coffee-house enemies -- "the rich." As Buffett knows, apparently better than Obama, the tax rate is completely irrelevant to the truly wealthy. The truly wealthy can arrange things so that they have zero income for tax purposes, so who cares whether the tax rate is 30 percent or 100 percent. 30 percent of zero is zero. That's math that the President and his crew don't seem to understand.

But, it all sounds good I guess, to the uninformed. There is no question that this is class warfare and shows a President of the United States several shades to the left of the most socialist leaders in Europe. Whether Obama gets his way on all of this economic nonsense is yet to be seen.

The rich have nothing to fear from this President and they know it. That's why most of the truly wealthy support Obama now and will continue to support him throughout his political career. Those with modest incomes and those among the youth, the aged and the minorities, whose futures are blighted by the economic mess that the Administration has created, have little to look forward to.

America's economic stagnation will continue and it's dwindling world economic stature will continue with the kind of policies advocated by President Obama. Only free markets and capitalism can provide a rebirth to the American economy. Overbearing government will simply lead to more and more economic decline for what once was the most vibrant economy in the world.

Instead the President launched a variety of attacks against his coffee-house enemies -- "the rich." As Buffett knows, apparently better than Obama, the tax rate is completely irrelevant to the truly wealthy. The truly wealthy can arrange things so that they have zero income for tax purposes, so who cares whether the tax rate is 30 percent or 100 percent. 30 percent of zero is zero. That's math that the President and his crew don't seem to understand.

But, it all sounds good I guess, to the uninformed. There is no question that this is class warfare and shows a President of the United States several shades to the left of the most socialist leaders in Europe. Whether Obama gets his way on all of this economic nonsense is yet to be seen.

The rich have nothing to fear from this President and they know it. That's why most of the truly wealthy support Obama now and will continue to support him throughout his political career. Those with modest incomes and those among the youth, the aged and the minorities, whose futures are blighted by the economic mess that the Administration has created, have little to look forward to.

America's economic stagnation will continue and it's dwindling world economic stature will continue with the kind of policies advocated by President Obama. Only free markets and capitalism can provide a rebirth to the American economy. Overbearing government will simply lead to more and more economic decline for what once was the most vibrant economy in the world.

Tuesday 24 January 2012

Podesta Needs a Reality Check

The op-ed in today's Wall Street Journal co-authored by John Podesta, life long Democratic Party strategist, suggests that the "clean energy" industry is soon to reduce America's dependence on foreign oil. That is so absurd as to be laughable.

One supposes that this article was trotted out to defend the indefensible -- the Obama decision not to give the go-ahead to the Keystone pipeline project that would have permitted the US to tap Canada as an oil source instead of Syria.

There is no "clean energy" industry out there, either in the US or China, that has any potential to reduce America's or anyone else' dependence on fossil fuels. To pretend that there is, is irresponsible.

Whatever there may or may not be to a "clean energy" industry is far into the distant future and will only come into existence when the free market wills it so. Governments will just continue to waste taxpayer money. Does anyone really think wasting money on the Solyndras of the world will be a substitute for entrepreneurship and the free market?

Podesta should be ashamed of this article.

One supposes that this article was trotted out to defend the indefensible -- the Obama decision not to give the go-ahead to the Keystone pipeline project that would have permitted the US to tap Canada as an oil source instead of Syria.

There is no "clean energy" industry out there, either in the US or China, that has any potential to reduce America's or anyone else' dependence on fossil fuels. To pretend that there is, is irresponsible.

Whatever there may or may not be to a "clean energy" industry is far into the distant future and will only come into existence when the free market wills it so. Governments will just continue to waste taxpayer money. Does anyone really think wasting money on the Solyndras of the world will be a substitute for entrepreneurship and the free market?

Podesta should be ashamed of this article.

Monday 23 January 2012

Republicans In the Mud

It is hard to see either Mitt Romney or Newt Gingrich emerging with much of a claim to lead a major political party campaign after the absurd performance in Tampa tonight. Instead of discussing the economy and the important campaign issues, the main spotlight was on who was the biggest devil in the room. The President must have enjoyed this debate.

Sunday 22 January 2012

State and Local Pension Reform

As everyone by now must know, state and local defined benefit pension funds are broke and are not sustainable in their present form. So, what should be done?

Most states are creating Rube Goldberg machines to "reform" their state pension systems. Virginia is a good example. The proposals by the McDonnell Administration recently unveiled have the potential to make a bad system even worse.

What should state pension funds look like?

If you lump defined benefit pension funds in with social security, it is easy to see the overall problem -- the absence of saving. Social security is a net dis-saver (that's really the meaning of the "social security trust fund") and defined benefit systems have the effect of encouraging state workers to dramatically reduce their personal savings because of the expectation of future benefits. The result is that the national savings rate plummets effectively to zero (except for the savings done by the wealthy and by the corporate sector).

If savings are negligible, then there are no assets to support retirees (or to support young folks either). That's the problem in the US. Our assets are declining (Mostly by being purchased by non-US entities). It is as if the squirrels quit gathering acorns to prepare for the winter. When the winter comes, there are no acorns. For a while, you might be able to borrow acorns from the squirrels down the road, but that will only postpone the inevitable disaster.

Retirement plans should be about accumulating savings. The rationale behind defined benefit plans was that states would do the accumulating (ditto with social security), but we know that didn't work. States, all of them, use various accounting tricks and political excuses to avoid providing the necessary accumulation of assets to support future retirees. Early retirees win, but later retirees have no hope of winning.

Here is what a state retirement system for employees should look like: Employees should be required to put away five percent of compensation. The state can kick in another 2 1/2 percent. The total 7 1/2 percent should be exempt from current taxation so that it would essentially be structured like an IRA. Individuals should not be permitted to withdraw anything until age 65. Period. Individuals should be permitted to invest the money however they choose.

On top of the 7 1/2 percent the state could provide a 1 for 3 match up to some maximum. For example, if the employee chooses they could save another three percent of income and the state would match that with an addition one percent contribution. Imagine that you capped this at 9 percent (with a 3 percent kick-in by the state). Adding it all up, an employee could potentially end up saving 7 1/2 plus 9 plus 3 for nearly 20 percent annual, tax-deferred saving.

Notice that system would cost the state, at most 5 1/2% (or a mere 2 1/2 % if no one opts to go for the match) of total payroll. The employee would end up with annual savings of between 7 1/2 percent and 19 1/2 percent depending upon how much they choose to take advantage of the "free-money" match).

People could then choose the lifestyle they want in retirement: minimal or maximal. The state could lock in its liability to current contributions. Unfunded liability would be impossible in this system.

Best of all, aggregate savings would increase without question. Thus, the acorns would be available when winter comes as opposed to the almost complete absence of acorns that the current system promises.

The only objection to this is the old and tired excuse that employees cannot competently invest their own money. TIAA-CREF is the largest pension fund in

America and the most successful. The employees choose their own investments in TIAA-CREF and I doubt that any participant has ever voiced any real complaint about this system. So, individual investing works, contrary to popular myth. People do learn.

A similar structure could be used for social security. Together these reforms would create adequate savings for comfortable retirements for all Americans and get government out of the "unfunded liability" business.

These are the reforms needed, not the half-baked measures that are currently under review.

Most states are creating Rube Goldberg machines to "reform" their state pension systems. Virginia is a good example. The proposals by the McDonnell Administration recently unveiled have the potential to make a bad system even worse.

What should state pension funds look like?

If you lump defined benefit pension funds in with social security, it is easy to see the overall problem -- the absence of saving. Social security is a net dis-saver (that's really the meaning of the "social security trust fund") and defined benefit systems have the effect of encouraging state workers to dramatically reduce their personal savings because of the expectation of future benefits. The result is that the national savings rate plummets effectively to zero (except for the savings done by the wealthy and by the corporate sector).

If savings are negligible, then there are no assets to support retirees (or to support young folks either). That's the problem in the US. Our assets are declining (Mostly by being purchased by non-US entities). It is as if the squirrels quit gathering acorns to prepare for the winter. When the winter comes, there are no acorns. For a while, you might be able to borrow acorns from the squirrels down the road, but that will only postpone the inevitable disaster.

Retirement plans should be about accumulating savings. The rationale behind defined benefit plans was that states would do the accumulating (ditto with social security), but we know that didn't work. States, all of them, use various accounting tricks and political excuses to avoid providing the necessary accumulation of assets to support future retirees. Early retirees win, but later retirees have no hope of winning.

Here is what a state retirement system for employees should look like: Employees should be required to put away five percent of compensation. The state can kick in another 2 1/2 percent. The total 7 1/2 percent should be exempt from current taxation so that it would essentially be structured like an IRA. Individuals should not be permitted to withdraw anything until age 65. Period. Individuals should be permitted to invest the money however they choose.

On top of the 7 1/2 percent the state could provide a 1 for 3 match up to some maximum. For example, if the employee chooses they could save another three percent of income and the state would match that with an addition one percent contribution. Imagine that you capped this at 9 percent (with a 3 percent kick-in by the state). Adding it all up, an employee could potentially end up saving 7 1/2 plus 9 plus 3 for nearly 20 percent annual, tax-deferred saving.

Notice that system would cost the state, at most 5 1/2% (or a mere 2 1/2 % if no one opts to go for the match) of total payroll. The employee would end up with annual savings of between 7 1/2 percent and 19 1/2 percent depending upon how much they choose to take advantage of the "free-money" match).

People could then choose the lifestyle they want in retirement: minimal or maximal. The state could lock in its liability to current contributions. Unfunded liability would be impossible in this system.

Best of all, aggregate savings would increase without question. Thus, the acorns would be available when winter comes as opposed to the almost complete absence of acorns that the current system promises.

The only objection to this is the old and tired excuse that employees cannot competently invest their own money. TIAA-CREF is the largest pension fund in

America and the most successful. The employees choose their own investments in TIAA-CREF and I doubt that any participant has ever voiced any real complaint about this system. So, individual investing works, contrary to popular myth. People do learn.

A similar structure could be used for social security. Together these reforms would create adequate savings for comfortable retirements for all Americans and get government out of the "unfunded liability" business.

These are the reforms needed, not the half-baked measures that are currently under review.

Friday 20 January 2012

CLSA Feng Shui Index 2012

In conjunction with the coming Chinese New Year, Finance Malaysia would like to bring to you another popular research report - funny and interesting - by CLSA. This year is called "Water Dragon" year. Is it a good or bad dragon? What does water means to this dragon? And most importantly, what's the predictions of markets from the angle of feng shui?

Prediction pattern patent pending

Past performance, as the tiny type whispers, is no guarantee of future behavior. After all, it may be no guarantee, but it's pretty much all we've got to go on. No matter how mathematically marvelous the model, how impossibly rational the behavior or how serial the killer instinct, not too far beyond the smirk and mirrors, precedent is invariably at play.

That the past is present in the future is fundamental to feng shui forecasting, which is why we slipped on the archaeological geomancy fancy-pants and took the pith helmets to pore over the charted remains of the most recent Wyrms Past - a sort of reverse inter the Dragons. Sadly, there's not much to seer among dem dry bones. A few scraps of scapula, but nothing oracular. Humerus? Not around this joint.

|

| Would KLCI this year's pattern turn out to be like this? |

We doubt that even market historian Yale Hirsch could discern any distintive Draconic DNA in the squiggles and highlights left and south. That they mark the start of every third Presidential Election Cycle doesn't help us much, especially given that Hirsch's theory has fallen flat of late. At the risk of straying into 'one hand clapping' and 'unknown unknowns' territory, perhaps that's the pattern: Dragons are simply predictably unpredictable.

Elemental Health Check:

Metals Sector:

Financials, Gold, Resources, Autos, Banks, Broking, Computer Hardware, Currencies, Dental, Engineering, Legal, Steel.

Wood Sector:

Retail, Agriculture, Education, Fashion, Forestry, Furniture, Garments, Packaging, Pulp and Paper, Plantations, Politics, Printing, Textiles, Traditional Media, Soft Commodities.

Water Sector:

Gaming, Transport, Fishing, Beverages, Marketing, Tourism.

Fire Sector:

Oil and Gas, Technology, Telecoms/Internet, Utilities, Accounting, Advertising, Aviation, Economics, Electrical Entertainment, Energy, Fast Food, Foundries, Petrochems, Services.

Earth Sector:

Agriculture, Building Materials, Cement, Chemicals, Construction, Developers, Government, Hotels, Human Resources, Cosmetics, Insurance, Management, Pharmaceuticals, Property.

Source: CLSA

Tuesday 17 January 2012

Credit Suisse's 2012 Malaysia Outlook

After looking into all those research reports on 2012 market outlook by local securities or research houses, it's time for foreign research houses. In this series of 2012 outlook, we kick start with Credit Suisse's report, in which a section of it was written specifically on Malaysia. And, below is the excerpt from it.

Malaysia’s GDP growth to outperform its regional peers'?

Real GDP growth expanded 5.8% yoy in Q3, led by strong private consumption (7.4% yoy) and fixed investment (6.1% yoy), and a surge in government consumption (21.8% yoy). On a seasonally adjusted basis, we estimate that GDP expanded 4.6% qoq annualized in Q3, stronger than that of Korea, Thailand, Singapore, the Philippines, Hong Kong, and Taiwan. Malaysia remains highly exposed to a sharp slowdown in the developed world, but, on a relative basis, we think its domestic demand will hold up better than that of the other small open economies in the region. We expect private consumption growth to remain robust, partly due to high palm oil prices. In addition, fiscal spending from the government should continue to help boost spending in the next few quarters. We think there is upside risk to our 2011 real GDP growth forecast of 4.6%. Our 2012 GDP growth forecast remains unchanged at 4.8%.Fiscal boost ahead of the next general election?

With revenues coming in much higher than budgeted this year as well as the backloading of the planned expenditure, the government has room to boost spending in the next few quarters. The

government spent RM154bn in the first three quarters of the year. Its revised 2011 budget suggests that it plans to spend another RM76.8bn (9% of GDP) in Q4, which is 20% yoy more than it spent in Q4 last year. Moreover, in its 2012 budget, the government announced one-off cash transfers to the poor, bonus payments and pay rises for civil servants, as well as various tax exemptions. Most of these are scheduled to happen in early 2012, which should provide a boost to sentiment and private consumption. The ‘people friendly’ budget suggests that the general election, which needs to be held by March 2013, might be near. We expect the government to continue to pump prime the economy before the next general election.

The result of the general election will determine the prospects for structural reforms. The government announced in the budget speech that it will liberalize another 17 services sub-sectors in 2012, including medical, architectural, engineering, accounting, legal, education and telecommunications services. However, there has been no news on subsidy reform or the goods and services tax. We think Malaysia has made some progress in its reforms, as reflected in improved rankings in the global competitiveness index (calculated by the World Economic Forum) and ease of doing business survey (published by the World Bank). However, the less popular reforms have been postponed and appear unlikely to happen before the general election. Its ranking on Transparency International’s Corruption Perceptions Index has also slipped in recent years. Our base case scenario is that Prime Minister Najib will win the general election, but fall short of regaining the two-thirds majority lost in the last general election. The quality of the win will determine whether Najib will stay as prime minister and gain

enough support to push through further changes, in our view.

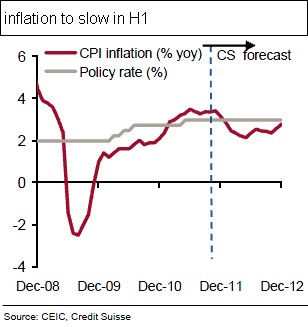

Monetary policy to stay defensive

With risks surrounding the euro zone remaining high and inflation likely to fall below 3% yoy in Q1 2012, we think BNM will remain data dependent and be ready to cut the policy rate if needed. Our forecast suggests BNM will keep the policy rate on hold until end-2012. However, if the global growth outlook deteriorates in the coming months, we think BNM has both the scope and willingness to cut the policy rate. Similarly, we think the ringgit will continue to trade in line with its regional peers in the near term. However, we think BNM might allow some ringgit out-performance if and when the euro zone situation stabilizes, given that Malaysia’s current account surplus remains strong, domestic demand resilient, and there are signs of pick-up in US economic activity. Domestically, the election result should also be an important determinant of capital flows. A poor outcome for the ruling party could lead to heightened political uncertainty and capital outflows.

Source: Credit Suisse

Check Out Iceland

Faced with a banking system that was broke, Iceland simply let their major banks fail. This happened three years ago as the US and Western Europe were busily fashioning government rescue plans. No rescue plan for Iceland! Nope!

They just let them fail.

So, what happened? Did their civilization end? No. Iceland today is the one of the fastest growing countries on the globe. Business is booming, unemployment has cratered, and good times are back. This, in just three short years after Iceland let nature take its course. (A pattern very similar to what happened in Asia after the 1997 collapse of Asian financial institutions).

This story is laid out in detail in today's Washington Post in an article by Brady Dennis with the fetching title: "Could US and Europe Learn a Thing or Two from Iceland's Financial Collapse?"

All of those who say that the TARP and other government bailouts were essential should take note of what happened when governments stepped aside (which doesn't happen often, but it does happen occasionally). Take heed of the aftermath of the Asian crisis in 1997 and what happened in Iceland in the past three years.

Economic growth, prosperity and recovery are critically dependent upon government inaction. Activist policies just guarantee slow growth and massive economic dislocation. A generation of stagnation will be the reward for the US government activism in 2008 and 2009. Fortunately, for Iceland, they chose a rational road and are prospering mightily for their own government's inaction.

They just let them fail.

So, what happened? Did their civilization end? No. Iceland today is the one of the fastest growing countries on the globe. Business is booming, unemployment has cratered, and good times are back. This, in just three short years after Iceland let nature take its course. (A pattern very similar to what happened in Asia after the 1997 collapse of Asian financial institutions).

This story is laid out in detail in today's Washington Post in an article by Brady Dennis with the fetching title: "Could US and Europe Learn a Thing or Two from Iceland's Financial Collapse?"

All of those who say that the TARP and other government bailouts were essential should take note of what happened when governments stepped aside (which doesn't happen often, but it does happen occasionally). Take heed of the aftermath of the Asian crisis in 1997 and what happened in Iceland in the past three years.

Economic growth, prosperity and recovery are critically dependent upon government inaction. Activist policies just guarantee slow growth and massive economic dislocation. A generation of stagnation will be the reward for the US government activism in 2008 and 2009. Fortunately, for Iceland, they chose a rational road and are prospering mightily for their own government's inaction.

Romney Is The Only Adult in the Room

The debate in South Carolina last night revealed what everyone has long known and no one has been willing to say: Romney is the only truly viable candidate that the Republicans have. Gingrich and Perry have revealed themselves as attack dogs against capitalism, Santorum has a non-sensical tax plan that would create a distinction in tax law between manufacturing companies and all other companies, and Ron Paul is delightfully irrelevant. That leaves only Romney, who, admittedly from his resume, is Obama-lite.

It is interesting irony that in the day of the tea party, there is no real conservative alternative to Mitt Romney. Romney will be the Republican nominee. It is time for the other guys to admit reality and head home.

It is interesting irony that in the day of the tea party, there is no real conservative alternative to Mitt Romney. Romney will be the Republican nominee. It is time for the other guys to admit reality and head home.

Saturday 14 January 2012

Annual Strategy 2012 by TA Securities

2011 had triggered a wave of unwanted chain effects, which would not languish but resonate further into 1H12. While Japan is recovering from the worst ever tsunami and nuclear disaster, and oil prices stabilized after the unrest in the Middle East, conditions in Europe are expected to worsen before stabilizing.

Global Economy – Risk Factors Extending into 2012

Positive news flows on drastic measures to restore confidence in Europe and maintain the credit ratings of core economies could boost market sentiment in early 1Q12 and push the index to test the all‐time high of 1,597. However, the reality check on the implication of European austerity measures and rising market risk premium due to the 13th General Election (GE) could push the index around 1,200 levels in 1H12 based on a minus two standard deviation from its last decade’s historical mean of 16.6x.

A revival should ensue in the following months due to oversold conditions and anticipation of a subsequent recovery in Eurozone economy by mid‐2013 as markets move ahead by about six months. Our end‐2012 target is 1,520 based on a mid‐cycle PER of 13x.

Malaysia – Not Insulated

In the first nine months of 2011, the Malaysian economy registered a modest growth of 5.1% YoY thanks to the robust domestic demand and strong exports. In some ways, despite the turbulent external environment, rebuilding and reconstruction activities in Japan had helped spur Malaysia’s exports advancement during 3Q11. Nevertheless, the external sector is expected to remain challenging in 4Q11 before embracing a slowdown in 2012 amid the budget deficit cuts in the European Union, the slow economic rebound in the US and the anticipated softening of China’s economy. Hence, we expect Malaysia’s economic growth to narrow to 4.6% in 2012 following a 5.2% growth expectation for 2011.

On the fiscal front, the financial status of the Federal Government may continue to improve in tandem with the embodiment of fiscal prudence and boost in revenue. Overall consumer prices are expected to increase by 2.5% while monetary policy is expected to remain accommodative (OPR stable at 3.0%). A potential wild card is the reform agenda initiated by Prime Minister Najib Tun Razak. Factors that would accelerate reform include:

- increasing political consciousness and demographic shift,

- reenergizing investment in the local economy, and

- strengthening fiscal credibility. Sectors that could benefit are Banking, Property and Power.

Political Risk?

We strongly believe the country’s 13th general election will be due in 1QFY12, especially before the parliament convenes in March. This could be a major dampener upon dissolution of the parliament as investors would exit and remain on the sideline until the outcome is known and the implications are digested. The ruling coalition is expected to retain its victory but its grip on parliamentary and state seats are expected to weaken. Thus, the effectiveness in implementation of policy reforms and domestic expansionary measures could be compromised and will be closely watched in 2012. With the backdrop of slowing external demand, spending on domestic infrastructure, construction and oil & gas sectors would be the key focus in 2012.

Investors should take profit on any rally over the next three months and wait to cherry pick. Traders should take short‐term positions to trade, mainly on blue chips, in anticipation of a year‐end and New Year rallies and exit by March. We expect higher downside risks in 1H12 as the flow of negative economic data, earnings downgrades and possible 13th general election hurt investor sentiment.

Top Picks for 2012

We reiterate defensive approach in stock selection in current uncertain period and bottom up approach in choosing value picks. Preferred buy picks are KIANJOO (TP: RM2.58), SEG (TP: RM2.51), SUNWAY (TP: RM3.16), BJTOTO (TP: RM4.92), BSTEAD (TP: RM6.21), KPJ (TP: RM5.04), GENM (TP: RM4.50), SAPCRES (TP: RM4.93), GAMUDA (TP: RM3.71) and SIME (TP: RM10.12).

Source: TA Securities

Friday 13 January 2012

S&P Downgrade Is Not News

The S&P downgrade is simply a public statement of what everyone already knows -- Eurozone debt is unsustainable. That France was included in the downgrade should surprise no one. Sooner or later the French government will be forced to absorb the balance sheets of the major French banks. The French are in as much trouble as everyone else.

Really important news will come when sovereign debt auctions begin to falter. That will happen. That will be the beginning of the end.

Far better is to face reality now and begin the "workout" process. But, politicians are loath to face reality on their own watch. So, don't look for anything good on the European sovereign debt front anytime soon.

But, the markets surely know all of this.

Really important news will come when sovereign debt auctions begin to falter. That will happen. That will be the beginning of the end.

Far better is to face reality now and begin the "workout" process. But, politicians are loath to face reality on their own watch. So, don't look for anything good on the European sovereign debt front anytime soon.

But, the markets surely know all of this.

Capitalism Under Siege

What do Warren Buffett and Newt Gingrich have in common? Actually, quite a lot. They both relish being in the spotlight and both dote on the sound of their own voice. Now, they have both joined the Rick Perry choir denouncing private equity as some kind of evil pursuit. Strange since all three -- Perry, Gingrich, and Buffett -- have all benefitted financially in a big way from private equity activities (or it's equivalents).

What next? Why not condemn LaBron James since his existence, no doubt, led to a basketball player losing his job.

Where does this absurdity end?

It's beginning to look like Romney may be an attractive candidate, if only because only he (and Ron Paul) seem to favor capitalism over the alternatives.

What next? Why not condemn LaBron James since his existence, no doubt, led to a basketball player losing his job.

Where does this absurdity end?

It's beginning to look like Romney may be an attractive candidate, if only because only he (and Ron Paul) seem to favor capitalism over the alternatives.

Thursday 12 January 2012

Unbelievable 1Malaysia Amanah Rakyat Scheme?

Did you watch TV news just now? There is a good news for Malaysian who are looking for higher saving rate for their monies. Yes. I am talking about the fresh from oven 1Malaysia Amanah Rakyat scheme. The scheme was launched by Prime Minister, which aimed at helping those with a monthly household income of RM3,000 and below.

Unlike the previous series, the new scheme was a hybrid of a unit trust investment and loan product, capable of generating a consistent cash flow or monthly income. It will be made available from Jan 30. But, the best part is it comes with a Guaranteed return. Unbelievable?

The limit is RM5,000 and it can be bought through savings or investment loans from selected financial institutions, such as Maybank, CIMB, RHB and BSN. Investors would get a guaranteed RM134 monthly and for those who borrow, they only need to pay RM84 a month and still get RM50 in profit.

Too Good to be TRUE?

Let's us calculate the return on investment. If investors fork out RM5,000 themselves to invest, the return would be RM1,608 per annum (RM134 x 12 months) and was equivalent to 32%. You don't have to calculate again. It's 32%, some more guaranteed.Well, how about by borrowing the RM5,000 investment capital? If you borrow to invest, based on the RM50 net profit per month, it works out to be RM600 profit per year or equivalent to 12% return. Still consider very good. Nope, it was infinite return though because basically you pay nothing up-front to make 12% return, right?

Comparing to Fixed Deposit rate of only 3.25% per annum currently, 32% is 10 times that figure. Example, if you put your money into the new scheme, it was equivalent to putting your money into 12months FD for 10 years!!!

How did PNB guarantee?

Frankly speaking, Finance Malaysia really do not know. We're cracking our head hard now, and yet still do not have any clue. I think only PNB and Government know. Maybe, this is just another way of dishing out money to the hand of Rakyat. The special part is Government giving out beautifully this time indirectly (but, it still very obvious for us).

Tuesday 10 January 2012

Maybank 2012 Outlook & Issues: Tilt to Safety

2012 will be another volatile year, we expect, tracking closely headline news from abroad given unresolved macro conditions brought forth from 2011: high debts but low growth at the eurozone and US. Confidence continues to wane on a resolution to the debt crisis which is negative on sentiment and will destabilize growth.

We maintain our 2012 year-end KLCI target of 1,500 pts based on one standard deviation below mean on expectation of turbulence still at the external markets impacting sentiment and global growth. At the home front, it will be a year with potentially two major elections:

- an early 13th general elections (13GE) and

- UMNO party elections for the top posts in 4Q 2012, where the elected party president will helm the country’s premiership position

Air Pockets Ahead?

That eurozone’s debt crisis has stayed unresolved means that there is still default risk. We expect higher bouts of volatility in 1H 2012 where much of the PIIGS and US government bonds will mature. Other risks are potential deleveraging by the European banks which could lead to a credit crunch, which is recessionary in nature. The other risks are likely social uprising from tough austerity measures in the troubled economies and eventually, the fate of the euro itself.

Malaysia to out-perform, nonetheless. We expect Malaysian equities to out-perform again against a back-drop of external uncertainties and volatility. Cushioning the downside risk will be further traction on the ETP implementation, a resilient corporate earnings profile which is largely domestic focused, healthy corporate balance sheets, high domestic liquidity, stable foreign holdings, and strong participation of government linked investment funds in Malaysian equities.

- Macro blueprints will be fewer in 2012 after the New Economic Model (NEM), Government Transformation Programme (GTP), Economic Transformation Programme (ETP) and 10th Malaysia Plan (10MP) were unveiled in 2010, followed by the Strategic Reform Initiatives (SRI), 2nd Capital Sector Masterplan (2CSMP) and Financial Sector Blueprint (FSB) in 2011. 2012 will be a year of implementation for these blueprints, in our view.

- Nonetheless, the Malaysian market will not be dry of action with 3 major IPOs lined up in 1H: Gas Malaysia, Felda Global Ventures Holdings (FGVH) and Integrated Healthcare. Also, the possible re-listing of Astro’s domestic operations and Malakoff, the listing of AirAsia’s Indonesian and Thai associates and AirAsia X, and the REIT-ing of KLCC Property and Kris Assets’ assets.

- M&As will remain in flavour if market conditions stay, with the SapuraCrest-Kencana merger to complete in Mar 2012, creating a group of RM11b-RM12b in market value, either the 3rd or 4th largest in the oil & gas sector after Petronas Gas, Petronas Dagangan and Bumi Armada. We expect M&As to extend in the financial services (investment and Islamic banking) and oil & gas service providers.

- Government’s equity divestment will also continue, including on Khazanah’s holdings. In the news presently is Khazanah’s potential sale of its stake in Proton (it now has a 42.7% holding). Also, MAHB may see new equity issuance, thus, diluting Khazanah’s 54% stake. These measures will raise the liquidity of the Malaysian bourse.

Market strategy

We will continue to exercise caution expecting the dividend stocks with largely domestic focused earnings, to market outperform. Our top picks are Public Bank, Telekom, Berjaya Sports Toto and Axis REIT. We will add on selected ETP related thematics in oil & gas (top picks: SapCrest, Kencana) and construction (Gamuda, Hock Seng Lee), and the value stocks (Sarawak Oil Palms, TSH Resources, Hartalega) for medium-term gains. Sector wise, we are overweight on construction, gaming (number forecast operators), oil & gas and REITs.

Source: Maybank Kim Eng Research Report

Monday 9 January 2012

Conservative Economists' Foolishness

Today's Wall Street Journal shows that right wing economists are no better than their left wing brethren at separating economics from politics. Professor Robert Barro of Harvard University and the conservative Hoover Institution of Stanford University opines today for the Wall Street Journal that the Euro should be abandoned and outlines a gradual policy to convert the Euro back into the original currencies of the countries presently in the Eurozone.

Why does Barro reach this remarkable conclusion? "In light of the ongoing fiscal and currency crisis -- which is leaning strongly toward a centralized political entity that will likely be even more unpopular than the common currency -- I would suggest it would be better to reverse course and eliminate the Euro." Politics is the reason!

So, toss aside the enormous benefits of a single currency union simply because of the "ongoing fiscal and currency crisis." Nowhere does Barro propose any economic solution to the crisis, although there are several good candidates available. Instead, he simply throws up his hands and says "drop the Euro." If Illinois and California get in fiscal trouble, will Barro advocate a separate currency for Illinois and California to avoid their "ongoing fiscal and currency crisis?"

The common currency is a good idea and should not be abandoned. What should be abandoned is the idea that creditors and debtors cannot sit down and readjust their unrealistic contracts with one another. Going back to separate currencies, with the implicit idea that weaker countries will inflate their way out of their debtloads is a cop out.

On the same editorial page, the WSJ has another conservative economist arguing for a wealth tax. Why? Because income is hard to define, according to Professor Ronald MacKinnon of Stanford University. "The basic problem is that defining 'income' becomes progressively more difficult as income and wealth rise." So, is wealth any easier to define? What is a piece of land worth? or an old building? or anything that isn't trading on an exchange every day. McKinnon looks like a shill for the appraisal industry in this piece. His proposal would simply lead to an enormous incentive to hide wealth or distort its value in various ways, much as takes place today with reported income for tax purposes.

Professor McKinnon might raise the more relevant question: why is there such an enormous need for revenue? Answering that question might spares us more inefficiencies and distortions in our economy than McKinnon's proposed strategy of creating a new bonanza for tax lawyers.

Why does Barro reach this remarkable conclusion? "In light of the ongoing fiscal and currency crisis -- which is leaning strongly toward a centralized political entity that will likely be even more unpopular than the common currency -- I would suggest it would be better to reverse course and eliminate the Euro." Politics is the reason!

So, toss aside the enormous benefits of a single currency union simply because of the "ongoing fiscal and currency crisis." Nowhere does Barro propose any economic solution to the crisis, although there are several good candidates available. Instead, he simply throws up his hands and says "drop the Euro." If Illinois and California get in fiscal trouble, will Barro advocate a separate currency for Illinois and California to avoid their "ongoing fiscal and currency crisis?"

The common currency is a good idea and should not be abandoned. What should be abandoned is the idea that creditors and debtors cannot sit down and readjust their unrealistic contracts with one another. Going back to separate currencies, with the implicit idea that weaker countries will inflate their way out of their debtloads is a cop out.

On the same editorial page, the WSJ has another conservative economist arguing for a wealth tax. Why? Because income is hard to define, according to Professor Ronald MacKinnon of Stanford University. "The basic problem is that defining 'income' becomes progressively more difficult as income and wealth rise." So, is wealth any easier to define? What is a piece of land worth? or an old building? or anything that isn't trading on an exchange every day. McKinnon looks like a shill for the appraisal industry in this piece. His proposal would simply lead to an enormous incentive to hide wealth or distort its value in various ways, much as takes place today with reported income for tax purposes.

Professor McKinnon might raise the more relevant question: why is there such an enormous need for revenue? Answering that question might spares us more inefficiencies and distortions in our economy than McKinnon's proposed strategy of creating a new bonanza for tax lawyers.

Sunday 8 January 2012

The Drag from Minimum Wage Laws

When the economy is struggling to create new jobs and pull itself back up by its bootstraps, it is not helpful to have laws that make it illegal to create jobs. Minimum wage laws are exactly those kinds of laws. Someone who would like to make $ 6 per hour, rather than remain among the unemployed cannot legally do so anywhere in the United States. In San Francisco, it is not legal to take a job that pays $ 10 per hour! In many states, it is illegal to take a job making $ 9 per hour. It is also unlawful to offer anyone a job at these various rates in these various localities. That is what minimum wage legislation mandates.

What these laws are saying is that until the economy has made a dramatic recovery, those of our citizens at the bottom of the pile will have the boot heel of big government on their necks. Once unemployment rates are small and the boom is on, if that day ever comes again, then and only then can folks at the bottom of the talent pool have the legal right to work. Because only at the peak of the boom will wage rates for many jobs began to exceed the minimum wage levels that various states and municipalities, not to mention the federal government, have imposed.

This is unfair and economically absurd. When will politicians remove this obstacle from the hopes, dreams and aspirations of our citizenry at the bottom of the economic pile?

What these laws are saying is that until the economy has made a dramatic recovery, those of our citizens at the bottom of the pile will have the boot heel of big government on their necks. Once unemployment rates are small and the boom is on, if that day ever comes again, then and only then can folks at the bottom of the talent pool have the legal right to work. Because only at the peak of the boom will wage rates for many jobs began to exceed the minimum wage levels that various states and municipalities, not to mention the federal government, have imposed.

This is unfair and economically absurd. When will politicians remove this obstacle from the hopes, dreams and aspirations of our citizenry at the bottom of the economic pile?

Saturday 7 January 2012

RHB 2012 Market Outlook & Strategy: Another Challenging Year Ahead

As we head into 2012, a lot of uncertainty remains. On the external front, the euro-debt crisis remains unresolved despite five major attempts to stabilise it. Meanwhile, the economic conditions in the Eurozone are deteriorating rapidly with major indicators pointing to the region entering a recession. A deeper-than-expected recession in the Eurozone would leave few countries unscathed.

In particular, the US economy, which is still in low gear, will likely be severely impacted, while China may also be in for a more severe downturn as effects of potential policy easing will take time to filter down to the real economy.

Slower Eonomic Growth Envisaged For 2012?

The Malaysian economy will not be spared and will likely experience slowing export growth, though this will be cushioned by resilient domestic demand given the progress in the implementation of the Economic Transformation Programme. We expect the country’s economic growth to slow down more significantly to 3.6% in 2012, from +5.0% estimated for 2011. This points to weaker earnings growth, projected to slow from 10.5% to 7.8% during the same period for the FBM KLCI benchmark (ex-Tenaga).

Domestic Demand Likely Be More Resilient

With slowing economic growth, general election and multiple headwinds from the external sector, we believe investors will be in for another challenging year ahead. Given a number of significant risks in the horizon, our end-2012 FBM KLCI target is set at a conservative level of 1,480, based on unchanged 13x 2013 EPS. We expect a volatile 1H with sentiment gradually improving in the 2H as clarity on the global economy improves and investors begin to look forward to an economic rebound in 2013.

Non-election plays?

For investors looking for stocks that are less sensitive to the outcome of the election, we recommend KLK (one of Malaysia’s largest and independent plantation companies, with effi cient yields that have set the benchmark for the sector), Public Bank (large and defensive bank with a conservative and highly-regarded management), Digi (foreign-owned, well-run and in the broadly stable telecom industry) and Parkson (holding company for Parkson Retail Group listed in Hong Kong and Parkson Retail Asia listed in Singapore, with exposure to resilient retail growth in China, Vietnam and Southeast Asia). In addition, Sarawak stocks like HSL, Jaya Tiasa and Ta Ann are likely to be relatively immune, as the state election was already held in April, with two-thirds majority given to the incumbent Barisan Nasional-linked chief minister.

Strategy

As global headwinds remain strong and situations could get worse, we continue to advocate a defensive investment strategy, focusing on high dividend yielding stocks with reasonably good growth potential. Nevertheless, after a period of volatility, a recovery will undoubtedly follow and as such, we believe it pays for investors to accumulate fundamentally-robust stocks on weakness for tactical plays. Sector-wise, our key overweight are telecommunications, gaming, plantation, oil & gas and consumer.

Source: RHB Research Institute

Labels:

Bursa Malaysia,

DiGi,

dividend,

election,

ETP,

outlook,

Parkson,

Public Bank,

RHB

Friday 6 January 2012

200,000 New Jobs -- Nothing New Here

The unemployment report this morning showed the unemployment rate is down to 8.5 percent. This is being celebrated by the Obama Administration as stupendously good news.

Well, it's not bad news. It's just more of the same -- a slow, sluggish economic recovery consistent with 2 percent GDP growth continues to trudge along.

The only reason the unemployment rate is down to 8.5 percent, is that so many people (and this is the only real record that Obama has been able to set) have simply given up looking for work and have disappeared from both the numerator and denominator that makes up the unemployment rate. That's why Congress periodically extends unemployment benefits (also an Obama Administration record).

A good month would be 350,000 plus jobs. That's not going to happen with this Administration in the driving seat.

Well, it's not bad news. It's just more of the same -- a slow, sluggish economic recovery consistent with 2 percent GDP growth continues to trudge along.

The only reason the unemployment rate is down to 8.5 percent, is that so many people (and this is the only real record that Obama has been able to set) have simply given up looking for work and have disappeared from both the numerator and denominator that makes up the unemployment rate. That's why Congress periodically extends unemployment benefits (also an Obama Administration record).

A good month would be 350,000 plus jobs. That's not going to happen with this Administration in the driving seat.

Another Academic Economist in Action

Today's example of absurd economics coming from academia is Professor Uwe Reinhardt's blog post in this morning's NY Times entitled "What Price Pluralism in Health Insurance?"

It is really hard to believe that Professor Reinhardt put pen to paper with this nonsense. Here is his argument: In the US, people have a tough time figuring out which health insurance plan to buy because there is such a diversity of plans. No such problem exists in some European countries through the simple expedient of requiring everyone to purchase identical plans. "Premium shopping among insurers is easy, because the standard benefit package is common to all."

Why not apply this logic to cars, television sets, fitness centers, etc? If the government would simply mandate that only one type of car, only one type of television set, only one type of fitness center, etc, can exist, think how easy it would be for consumers to comparison shop! Consumers would no longer have to make the difficult decision between a Chevrolet and a Ford. Now, the government would require that Chevys and Fords be identical. What a boon for consumers, according to Professor Reinhardt.

This is, of course, the identical system that Russia and China once had in place. Consumer choice is "inefficient' and "expensive," according to Professor Reinhardt, who teaches this stuff to young folks at Princeton University.

Your tax dollars and tuition dollars at work.

It is really hard to believe that Professor Reinhardt put pen to paper with this nonsense. Here is his argument: In the US, people have a tough time figuring out which health insurance plan to buy because there is such a diversity of plans. No such problem exists in some European countries through the simple expedient of requiring everyone to purchase identical plans. "Premium shopping among insurers is easy, because the standard benefit package is common to all."

Why not apply this logic to cars, television sets, fitness centers, etc? If the government would simply mandate that only one type of car, only one type of television set, only one type of fitness center, etc, can exist, think how easy it would be for consumers to comparison shop! Consumers would no longer have to make the difficult decision between a Chevrolet and a Ford. Now, the government would require that Chevys and Fords be identical. What a boon for consumers, according to Professor Reinhardt.

This is, of course, the identical system that Russia and China once had in place. Consumer choice is "inefficient' and "expensive," according to Professor Reinhardt, who teaches this stuff to young folks at Princeton University.

Your tax dollars and tuition dollars at work.

Monday 2 January 2012

The Biggest Myth About The Euro

You hear it all the time. "They created a monetary union without a fiscal union." What complete nonsense that is. There is absolutely no need for a fiscal union in the Eurozone.

Those who push this notion: 1) completely ignore the US experience where, at least at the national level, there is a monetary union and fiscal union and, nonetheless, sovereign US debt is spiraling out of control; 2) if there was a "fiscal union," things would be far worse due to logrolling and moral hazard problems.

What is missing in the Eurozone is that those who owe money should sit down with their creditors and work out a repayment schedule that involves a substantial foregiveness of principal -- a partial (or perhaps nearly complete) default. Each country is and should be on its own.

If country A is profligate and spends money it doesn't have and if someone is foolish enough to lend them the money to do that, then why should country B be involved at all. Country B may have lived within its means and has no reason to bail out country A.

Markets will learn if country A defaults. Lenders will demand better behavior by country A and they will get it. It is the only way that country A will ever enact serious reforms. Country A will never bind itself to a serious austerity program for the sake of their creditors. It just will not happen, regardless of what Merkel-Sarcozy think.

The Eurozone is a great idea and should be preserved. A single currency union eliminates many of the bottlenecks of trade and finance and enhances economic growth. In the case of the Euro since 1997, lenders have blinded themselves to the differences between the credit-worthiness of the various countries that make up the Eurozone. Not any more. Thanks goodness. It is high time lenders woke up.

The very idea that somehow there is some political solution to this (using a bazooka to quote Hank Paulson) is ridiculous. The "print Euros" solution will destroy the European union as well as the Eurozone. Much simpler is to preserve the Euro and begin the process of writing down European sovereign debt -- country by country. Creditors deserve their fate in this one.

Those who push this notion: 1) completely ignore the US experience where, at least at the national level, there is a monetary union and fiscal union and, nonetheless, sovereign US debt is spiraling out of control; 2) if there was a "fiscal union," things would be far worse due to logrolling and moral hazard problems.

What is missing in the Eurozone is that those who owe money should sit down with their creditors and work out a repayment schedule that involves a substantial foregiveness of principal -- a partial (or perhaps nearly complete) default. Each country is and should be on its own.

If country A is profligate and spends money it doesn't have and if someone is foolish enough to lend them the money to do that, then why should country B be involved at all. Country B may have lived within its means and has no reason to bail out country A.

Markets will learn if country A defaults. Lenders will demand better behavior by country A and they will get it. It is the only way that country A will ever enact serious reforms. Country A will never bind itself to a serious austerity program for the sake of their creditors. It just will not happen, regardless of what Merkel-Sarcozy think.

The Eurozone is a great idea and should be preserved. A single currency union eliminates many of the bottlenecks of trade and finance and enhances economic growth. In the case of the Euro since 1997, lenders have blinded themselves to the differences between the credit-worthiness of the various countries that make up the Eurozone. Not any more. Thanks goodness. It is high time lenders woke up.

The very idea that somehow there is some political solution to this (using a bazooka to quote Hank Paulson) is ridiculous. The "print Euros" solution will destroy the European union as well as the Eurozone. Much simpler is to preserve the Euro and begin the process of writing down European sovereign debt -- country by country. Creditors deserve their fate in this one.

OSK 2012 Outlook: Be Nimble in the "Way of the Market"

OSK have a Neutral outlook on the Malaysian market going into 2012 as the combination of uncertain growth outlook in the US and Asia coupled with a possible recession in Europe cloud the prospects for strong earnings growth locally. While Malaysia is likely to avoid slipping into recession, the deficit reduction exercises undertaken by Eurozone economies may well tip their slow growing economies into a recession.

In any case, for Malaysia, OSK see earnings growth slipping to between mid single digits and low double digits, a pale shadow of what it was in 2006, 2007 and 2010 when earnings growth came in between 20 to 30%. Newsflow on developments surrounding the handling of sovereign debt in Europe and US will also likely to lead to volatile markets worldwide. As such, in the short term, we are faced with volatile markets which will likely give way to a dampened economic outlook. OSK advise investors stay cautious into mid 2012 and focus on Defensive sectors such as Consumer, Telco, Healthcare and Media. OSK's 2012 KLCI fair value is 1466 points based on a PER of 13.5x or 1 standard deviation below the historical average of 16.6x given the uncertain market conditions.

But, there are opportunities to TRADE?

That being the case, despite the overall Neutral stance, the volatility expected should give rise to plenty of Trading Opportunities. OSK advise investors to Trade on Cyclical sectors such as Banks, Oil & Gas and Construction as the market dips or rallies strongly. The trading strategy to adopt is:- Buy when the KLCI falls towards the 1300 points level as the broader market then offers a 10% upside to 2012 fair value. As Malaysia is not likely to enter into recession, earnings contraction was expected and value should emerge closer to 1300 points. A combination of still positive earnings growth, low foreign shareholding and the Economic Transformation Programme (ETP) should mean Banks (leading the economy), O&G and Construction (beneficiaries of the ETP) will present good entry points at that level of the market.

- Sell when the KLCI rises towards the 1500 points level as the market will be overpriced then. Fundamentals remaining weak. Although the 3Q2011 earnings season may have seen a slight improvement q-o-q, most of the improvement was focused on the Small caps where analysts have had time to pare down forecasts. On the flipside, Big caps continued to slide with the potential for more downgrades in the coming 2 quarters.

What are the sectors to focus on?

Which are the Top Picks?

Among the defensive stock calls, the Top 10 Defensive Buys are namely:

1) Axiata (FV: RM5.60) – The only listed Malaysian telco company that also offers a regional footprint in Indonesia, Singapore, India, Bangladesh, Sri Lanka and Cambodia. Still the cheapest Malaysian telco company at 13x PER.

2) Petronas Gas (FV: RM15.52) – Natural gas processor, importer and transmitter in Peninsular Malaysia with 80% of profits guaranteed by its mother company, Petronas. Growth catalyst in the form of new LNG import terminal in Melaka.

3) Telekom Malaysia (FV: RM5.15) – Incumbent fixed-line telecoms provider in Malaysia. Making waves via its new high-speed Internet offering Unifi that is acquiring new subscribers at a rate of 1,000 per day. Highest yields at 10–12%.

4) Guinness Anchor (FV: RM13.58) – Broadest brewery offering translates into defensive earnings in the event of an economic slowdown. Decent yields, coupled with the 2012 growth potential coming from the UEFA 2012 football tournament.

5) AirAsia (FV: RM4.57) – Largest Low Cost Carrier (LCC) in Asia; continues to outperform its regional airline peers. Potential IPO of regional associates and benefits from a partnership with MAS will be the catalysts for 2012.

6) KPJ Healthcare (FV: RM5.21) – Largest private hospital provider in Malaysia, which is growing its hospital chain by another five hospitals from the current 21 over the next three years. Growth areas are medical tourism and retirement care.

7) QL Resources (FV: RM3.62) – Largest manufacturer of surimi in ASEAN and second largest producer of eggs in Malaysia. It is replicating its business in Indonesia and Vietnam over the next 12 months.

8) Media Chinese International (FV: RM1.51) – Largest publisher of Chinese language newspapers in Malaysia. To benefit from falling newsprint prices in 2012.

9) Supermax (FV: RM5.50) – Second largest rubber glove maker in the world, which will benefit from a fall in latex prices, while demand remains resilient.

10) TRC Synergy (FV: RM0.76) – Leading Bumiputera contractor. Shortlisted for various packages in the KL MRT project and should be assured of some contracts over the next 12 months.

Source: OSK Research

Subscribe to:

Posts (Atom)